Among other things, sustainability in real estate was a very marginal concern in India, just seen as a CSR checkbox, a certification badge at the entrance, or a marketing line in investor presentations. However, that perception has deeply changed. Now, sustainability is not just a moral addition; it is a main factor affecting asset value, liquidity, and long term relevance.

Indeed, a clear and irreversible split is fast emerging throughout India's commercial real estate. On one hand, green-certified Grade A buildings are attracting premium tenants commanding higher rents and enjoying lower vacancy. On the other hand, there are non-compliant, energy-inefficient "brown" buildings that face accelerated deprecation, tenant attrition, and increase rapidly the risk of becoming stranded assets.

This is not a short-term trend driven by sentiment. It is a structural shift driven by capital markets, occupier mandates, and regulation, and it will define Indian real estate valuations for decades.

From CSR to Capital Strategy: Why Sustainability Now Drives Valuation?

This transformation of sustainability from a 'good-to-have' feature into a valuation driver is rooted in three powerful forces reshaping Indian real estate.

First, global capital has changed its rules. Institutional investors, sovereign wealth funds, and pension capital increasingly deploy money only into assets that meet ESG thresholds. Buildings that cannot demonstrate energy efficiency, emissions control, and water stewardship are now seen as higher-risk investments-regardless of their location or tenant history.

Second, occupiers are driving the change. The global Net-Zero goals and ESG disclosures bind the multinational corporations operating in India. Real estate forms a significant component of Scope 2 and Scope 3 emissions. Hence, the selection of offices is no more a facilities decision but rather a strategic one.

Third, quietly but steadily, the regulation is tightening. For instance, SEBI's BRSR framework requires listed companies to disclose detailed environmental metrics. Bad real estate decisions hurt on all three counts: ESG score, investor perception, and access to capital.

In their entirety, these forces have made sustainability a financial filter, separating future-ready assets from those on the way to obsolescence.

The Green Premium: When Sustainability Pays Real Money

The disparity in rental growth between green-certified and non-green-certified office space is now apparent in rental data for office properties in major Indian cities. According to Vestian and JLL’s forecast for 2025, green-certified office space has seen an increase in rental values of almost 20-25% over its non-certified counterpart. The biggest disparity is seen in cities like Bengaluru, NCR, Hyderabad, and Pune, which see major demand for office space from giant MNCs that have strict sustainable agendas in place within their business strategies. Green space is also backed in generating higher turnover cycles, thereby leading to higher occupancy and much lower down time for space filled in the previous occupation cycle.

This premium is not brand or beauty-driven. It is based on measurable economics:

- Reduces energy and water expenses

- Improved indoor air quality and performance at work

- Simplified adherence to ESG reporting requirements

- For the investors, these would mean:

- Higher effective rents

- Increased tenant retention

- Renting

- More stable Net Operating Income (NOI)

From the perspective of investment, the green building has become less risky and hence deserving of stronger pricing and tighter exit yields.

Market Penetration: Green Is No Longer Optional

India has reached a pivotal adoption level for which sustainability is no longer a rare phenomenon but mainstream. It can be seen that by the end of 2025, almost two-thirds of Grade A office spaces in prominent Indian cities such as Bengaluru and NCR are green-rated on parameters such as LEED, IGBC, or GRIHA rating systems, followed by the majority of new office spaces that come up as a sustainably embedable right from the start.

This is a level of inroads that literally changes the face of market dynamics. When green buildings comprise almost 66 percent of premium office spaces, then non-green office spaces no longer need to compete alongside best-of-breed buildings but get sucked into competing among themselves and dilapidated buildings. This is a level of effectiveness for corporate offices that literally changes the playfield for which the criteria matrix to choose a corporate office resembles a different set of questions altogether, a question of whether to choose a sustainably-built office or choose something else to begin with.

The Brown Discount: How Value Erodes Quietly

If green buildings enjoy a premium, brown buildings face a structural discount — one that compounds over time.

This “brown discount” shows up in multiple ways:

- Lower achievable headline rents

- Longer vacancy periods

- Higher tenant churn

- Rising operating and compliance costs

Unlike cyclical market downturns, this discount is permanent, because it is rooted in regulatory and behavioural change.

Age as a Risk Multiplier

Older buildings are especially exposed.

Commercial assets older than 10 years were typically designed in an era when:

- Energy efficiency norms were minimal

- Water scarcity was not priced into operations

- ESG disclosures were non-existent

As a result, many struggle to meet modern performance benchmarks without significant capital expenditure.

Industry data from Nasscom and Savills highlights the scale of the challenge:

- India has a retrofitting opportunity of 355–385 million sq. ft. of commercial office space

- This represents buildings that must be upgraded — or risk losing relevance entirely

- Failure to retrofit increasingly leads to tenant migration, particularly among MNCs with strict sustainability mandates.

Vacancy Rates Reveal Occupier Preferences

Occupier behaviour is best reflected in vacancy data — and the gap is widening.

- Green-certified buildings: Vacancy levels of 10–12%

- Overall office market average: 15–18%

This 5–7 percentage point difference has profound implications.

Higher vacancy triggers a negative spiral:

- Owners cut rents to attract tenants

- Lower rents reduce NOI

- Reduced NOI impacts asset valuation

- Access to capital for upgrades becomes harder

This is how brown buildings transition from underperforming assets to stranded ones — not overnight, but steadily.

What Does “Stranded Asset” Mean in Real Estate?

In real estate, a stranded asset is not abandoned — it is economically sidelined.

A stranded building typically:

- Cannot attract quality tenants at market rents

- Requires disproportionate capex to remain compliant

- Faces declining liquidity and weak exit demand

Unlike energy or infrastructure assets, real estate stranding happens quietly — through gradual irrelevance, not sudden shutdown.

Many owners underestimate this risk because cash flows may still exist today. But the trajectory is downward, not flat.

SEBI’s BRSR: The Silent Accelerator

One of the most underestimated drivers of this divergence is regulatory disclosure.

Under SEBI’s BRSR framework, listed companies must report:

- Energy consumption intensity

- Emissions performance

- Water usage and waste management

Real estate directly influences all three.

As disclosures become more transparent and comparable:

- Occupiers will increasingly select buildings that improve ESG scores

- Poor-quality buildings will appear as governance and sustainability risks

This elevates real estate decisions from operational choices to boardroom-level strategy.

Why This Is a Trend with a Long Shelf Life?

The green–brown divide is not a passing phase. It has long-term durability because:

- Climate risks are intensifying, not receding.

- Global capital is perpetually aligned with ESG frameworks.

- Non-negotiable Corporate Net-Zero commitments

- Regulatory scrutiny will deepen further.

Unlike earlier real estate cycles, which were driven either by interest rates or supply gluts, this shift is structural and irreversible.

What This Means for the Market?

For investors

- Brown assets carry hidden future liabilities

- Yield alone is no longer a sufficient risk metric

- Sustainability alignment protects long-term value and exit liquidity

For developers

- Green certification is now table stakes

- Retrofitting strategies must be proactive

- Future-proofing assets today is cheaper than rescuing them tomorrow

Sustainability Rises as Major Criteria for Residential as well as Commercial Property Within India

Sustainability in the real estate industry in India has made a seamless transition from being an add-on element to a necessity. In both the commercial and residential markets, sustainability in architecture, energy efficiency, and resource effectiveness have begun to alter demand trends, affect the creation of value, or determine relevance in the present context, primarily due to global commitments related to ESG considerations, changing demands, or stricter government norms.

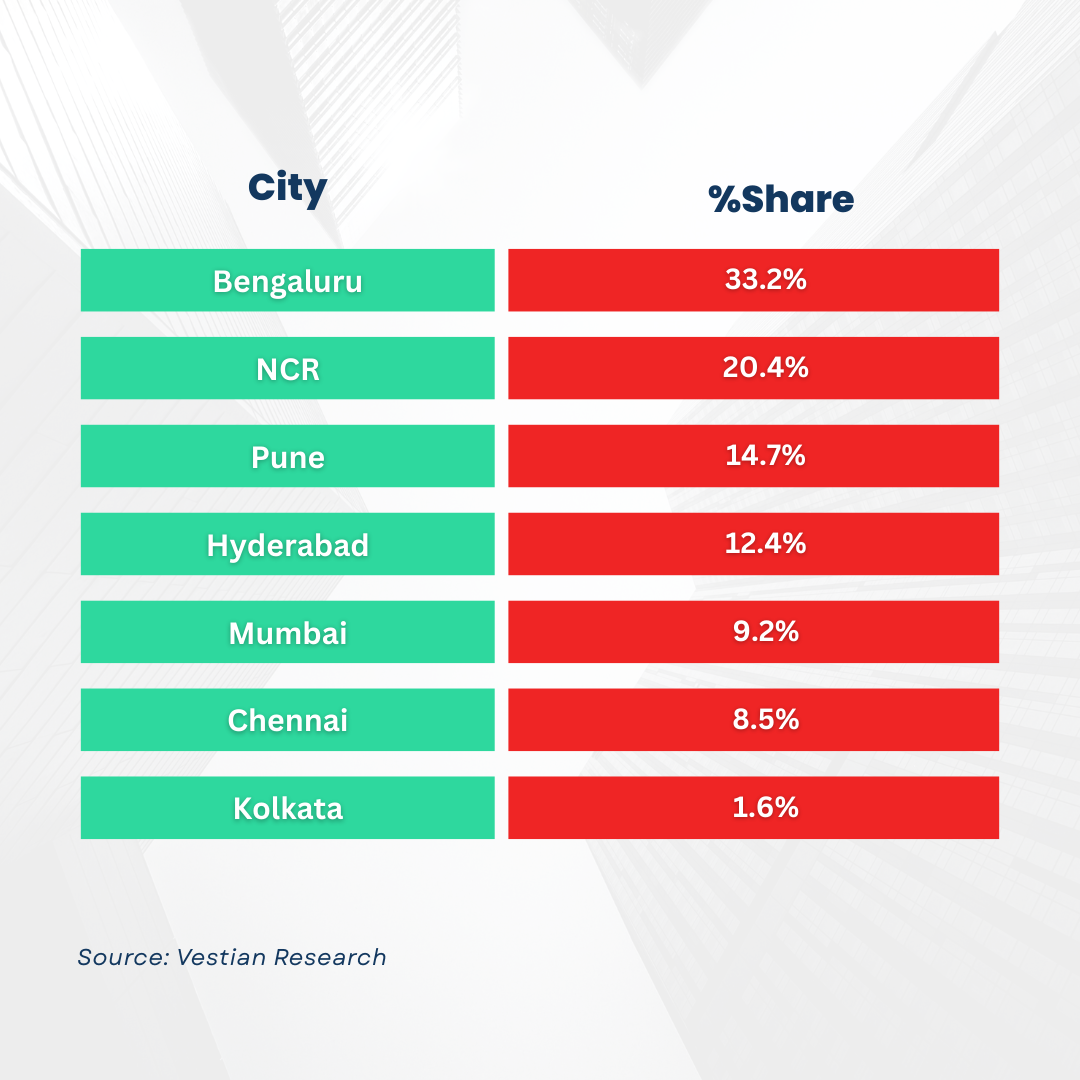

GCC Demand Reshapes Commercial Leasing

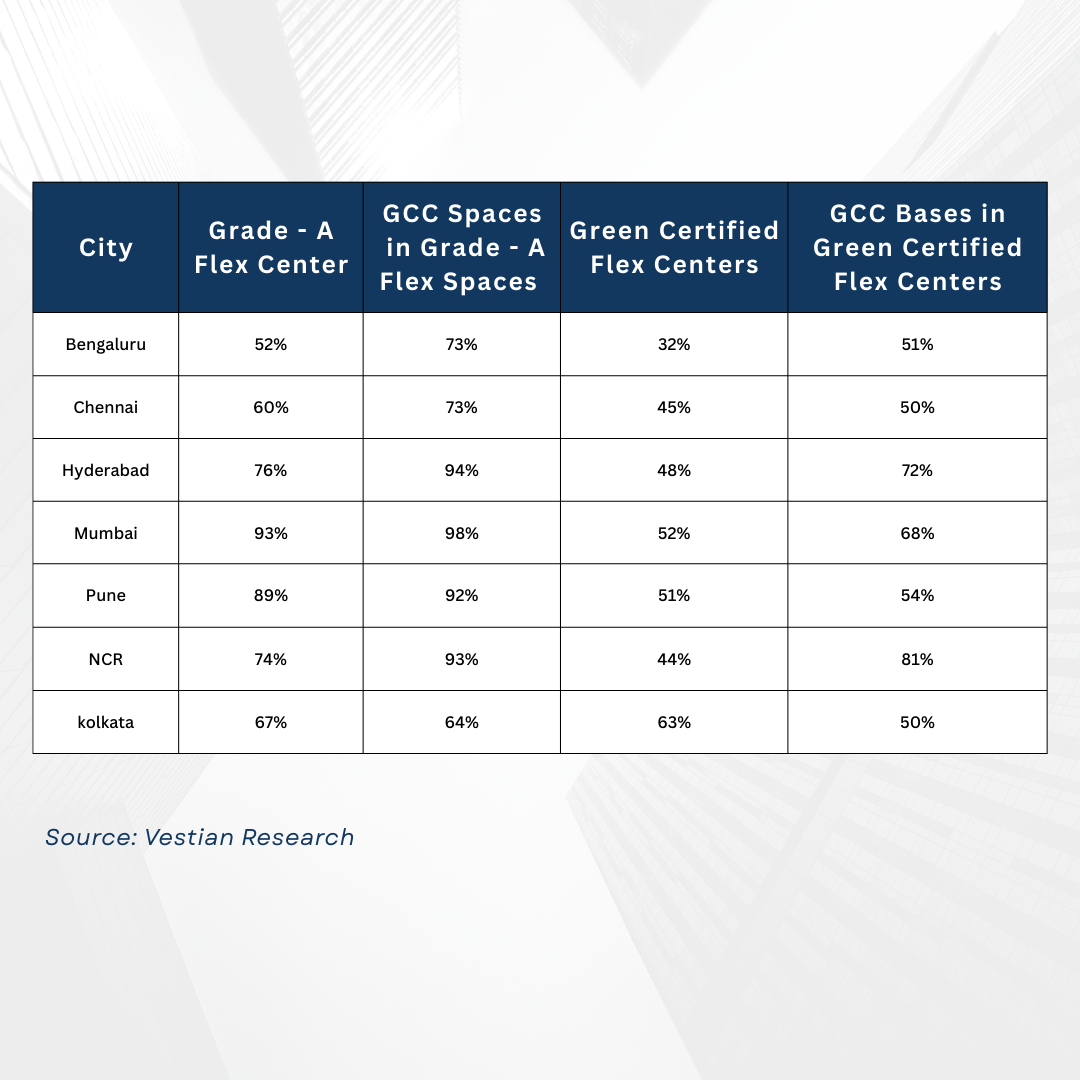

According to Vestian Research, India hosts more than 1,750 Global Capability Centre companies operating close to 3,800 bases, accounting for over 40 per cent of total office leasing activity in the past two years. As multinational occupiers align their real estate strategies with sustainability goals, green-certified and Grade-A office buildings have emerged as the preferred choice, particularly within the flex office segment.

According to data, "the majority" of GCCs that are leasing flex spaces are green-certified and high-quality projects. "Green features are increasingly mandatory," and as such, "Green qualities are now considered fundamental requirements for world-class occupiers, and green certification is mandatory."

Peripheral Business Districts on the Rise

From research in Vestian and analysis by Knight Frank in its India office market report, it is clear that Peripheral Business Districts have emerged as a new favorite destination over conventional CBD areas in cities like Bengaluru, Hyderabad, Pune, and Delhi-NCR and surrounding areas due to large floor plates, lower rentals, and possibilities to incorporate green and energy-efficient designs in campus developments.

Flex Office Expansion Anchored in Sustainability

The flex office market in India has grown leaps and bounds to meet the demand from GCCs. According to the research by Vestian, flex stock has crossed 82 million square feet across nearly 1,400 centres in the top seven cities, with supply expected to cross 100 million square feet by 2026. Sustainability-led upgrade is turning central as operators focus on green certifications and wellness standards to attract enterprise occupiers.

Residential demand for green living should rise.

The sustainability transition is comparably visible within residential real estate, too. A joint report by Resurgent India and NAREDCO estimates that by 2025, India's green building market will contribute nearly USD 39 billion, of which residential projects will form an increasing share. Energy efficiency, water conservation, and a healthier living environment are now pursued by more and more homebuyers as long-term cost and lifestyle considerations take priority.Redefining Luxury Housing Preferences

Redefining Luxury Housing Preferences

Under the Knight Frank Wealth Report and Savills India Residential Outlook, sustainability is recognized to be one of the new deciding factors in mid to premium, as well as luxury segments. Purchasers are beginning to measure new parameters of luxury such as efficiency, sustainable open spaces, and adaptability in a world where resources would be scarce.

NCR, Metros Drive Green Housing Sector

Results from the Anarock Consumer Sentiment Survey and the Business Standard Housing Tracker suggest that the cities which are leading the charge on sustainable residential developments are Delhi-NCR, Mumbai, Bengaluru, Hyderabad, and Pune. The one that emerges most prominently is the NCR, which has a very developed commercial-residential real estate ecosystem, along with a good level of acceptance of green certification among buyers.

IGBC Certifications Establish Marketplace Standards

As revealed in the annual report of the Indian Green Building Council, there are more than 7,000 projects in India that are green certified and have built a total built-up area of at least 1,370 million square feet. Such projects offer quantified results in reduced energy and water consumption, in addition to improved indoor air quality.

The guidelines on lending by the Reserve Bank of India based on ESG considerations and the guidelines on SEBI’s disclosures based on ESG considerations are some of the factors that are driving the adoption of sustainable real estate.” Green-certified commercial property and residential portfolios that are compliant with ESG considerations are being widely preferred by institutional investors due to lower risks associated with them.

Valuation Risks for Non-Compliant Assets

The JLL Future of Real Estate Report points to the increasing phenomenon of the “brown discount,” which affects properties that don’t meet sustainability standards. These properties are exposed to reduced occupancy rates, slower rent growth, and increased retrofitting challenges. Green-labeled properties still show enhanced absorption and rent resilience.

Sustainability is increasingly incorporated into occupier strategies, buyer preferences, and regulations, so that in itself is not a differentiation but the norm. Industry reports have shown that sustainable buildings that use resources efficiently will be what makes a market leader in the future, while non-compliant buildings will gradually see obsolescence.

Way Forward

The Indian real estate market is experiencing a paradigm shift in which sustainability is no longer separable from financial reality. The increasing divide between "green" and "brown" buildings is no longer a function of emotions or short-term policies but is based solely on economics: tenant requirements, access to capital, and sustainability risks. While the SEBI BRSR reporting regime for greater ESG clarity and Net-Zero aligned building owners among multinationals becomes the new norm, "brown" buildings will be seen as less relevant assets facing increasing vacancy rates and sustained value depreciation. On the other hand, "green" buildings are set to become the safe-haven investments of the future that can withstand market uncertainties and perform better in all aspects of liquidity and earnings stability. The destiny of a great divide is already set in motion. "Adapt or be left behind" is no longer a choice but a new reality for all market participants.

.png)