Key highlights from your Indian real estate capital investment report:

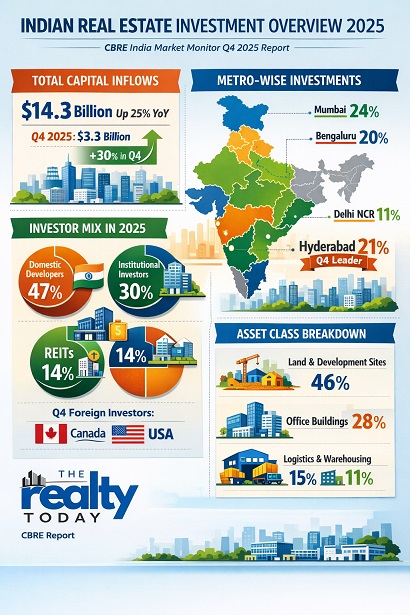

- Overall Investment Growth: Capital inflows into Indian real estate rose 25% YoY to $14.3 billion in 2025, signaling a revival of investor confidence across asset classes and geographies.

- Metro-Wise Share: Mumbai led with 24% of total annual investment, followed by Bengaluru (20%) and Delhi NCR (11%); Hyderabad captured 21% of Q4 investments, highlighting its growing appeal.

- Asset Class Trends: Land and development sites dominated with 46% of total inflows, while existing office buildings contributed 28%, reflecting strong demand for development plays and stabilized income-generating assets.

- Investor Composition: Domestic developers contributed 47% of total 2025 investment, institutional investors 30%, and REITs gained importance with 14% in Q4; domestic investors supplied ~80% of Q4 inflows, with Canadians and Americans accounting for major foreign participation.

Capital inflows into the real estate sector in India made a noticeable recovery in 2025. They increased by 25% yoy to $14.3 billion, thus indicating a revival of investor confidence in different asset classes as well as across various geographies.

This data can be traced from the CBRE India Market Monitor Q4 2025 Investments report that shows stock market rise was largely the result of continuous investor focus on the country's prime Tier 1 cities which included Mumbai, Bengaluru, and Delhi, NCR.

Fourth quarter alone (October, December) saw investments worth $3.3 billion, which is a huge jump of almost 30% from the same period last year. Such a record is a clear indication of the maturing process of the Indian real estate market, which gets support from a strong local participation, steady foreign investments, and the emphasis on development, led opportunities.

Mumbai attracted the biggest chunk of annual investment with 24% of the total, thus it remains the most preferred real estate market in India because of the depth, liquidity, and steady demand in residential, commercial, and redevelopment projects. Bengaluru came next with a 20% share, leveraging its city as a technology hub for the IT sector in India as well as a preferred market for office assets and mixed- use developments. Delhi NCR contributed 11% of total annual inflows, supported by better infrastructure, expanding residential corridors, and higher commercial activities.

Surprisingly, in Q4 Hyderabad took the lead in the investment market capturing 21% of the quarter 4 investments, followed by Delhi, NCR with 19% and Bengaluru with 15%. The city's robust fundamentals, availability of large development plots, and consistent growth in office leasing have made it quite appealing to both developers and institutional investors.

In terms of asset classes, land and development sites kept on being the main attraction for investors, making up more than 46% of total capital inflows in 2025 and 45% during Q4. This pattern shows the market's inclination towards long term development plays, especially in the residential and office segments. Existing office buildings continued to be the second, largest contributor, making up about 28% of annual inflows and 24% in the last quarter, thus reflecting ongoing demand for stabilized, income generating assets.

Additionally, warehousing and logistics facilities along with development platforms have also attracted investors during the year, thus showing a wider diversification of investment approaches. The report revealed that over 60% of the capital used in land and development transactions was invested in residential and office projects, with mixed- use developments and warehousing infrastructure coming next.

A significant development in the year 2025 was the increasing predominance of local capital in real estate. The developing companies were responsible for 47% of the total investment made in the sector throughout the year, thus unveiling their growing financial capability and power to lead large, scale projects. Institutional investors came next with a 30% share allowing REITs to gain in significance, especially the last quarter. In Q4 2025, the contribution of developers to the investment was 46%, institutional investors 29%, and REITs 14%, thus making up a nicely diversified investor mix.

In the fourth quarter, domestic investors took a leading role by supplying almost 80% of the total inflows, and thus, the foreign participation kept steady. Among foreign investors, the Canadians and the Americans comprised 52% and 26% of the foreign capital inflows in Q4, respectively. Also, the quarter saw the inception of $440 million worth of investment and development platforms, which is a sign that the parties are taking a step in the direction of structured partnerships and long, term collaboration between the residential and office sectors.

Commenting on the evolving investment landscape, Anshuman Magazine, Chairman and CEO of CBRE for India, South-East Asia, the Middle East, and Africa, said, “The depth of domestic capital, complemented by steady foreign participation, positions India well for continued momentum in 2026.”

Looking back, 2025 saw India's real estate sector performing exceedingly well on various fronts including market fundamentals, degree of institutionalisation, and developer, investor confidence levels. Going forward, the sector would pretty much stay on the same track if development, driven investments remain the major force and domestic capital the main player. This is also considering that urbanisation, infrastructure buildup and increased demand from end users in metropolises would be the three main growth drivers in 2026.

Image- freepik.com

.png)