The residential plot market saw heightened interest since 2022 as investors chased higher returns and developers looked for quick cash flow. According to a report by NSE-listed real estate data analytics firm PropEquity, nearly 4.7 lakh residential plots across the top 10 tier I and tier II cities have been launched by developers between 2022 and 2025 (May) with realtors in the top seven tier II cities supplying 2.43 lakh residential plots, accounting for 52%.

Hyderabad, Bengaluru and Chennai were the only tier I cities that featured in the top 10 accounting for the supply of nearly 2.25 lakh residential plots (or 48% supply share) between 2022 and 2025 (May).

The top 10 cities with the most supply between 2022 and 2025 (May) are Hyderabad, Indore, Bengaluru, Chennai, Nagpur, Jaipur, Coimbatore, Mysore, Raipur and Surat.

In the first five months of 2025, 45,591 residential plots have been launched, which is 36% of the supply in CY 2024 and 28% of the supply in CY 2023.

Samir Jasuja, Founder and CEO, PropEquity said, “The estimated launch value of the residential plots in 10 tier I-II cities between 2022 and 2025 (May) is approximately Rs 2.44 lakh crore. Residential plots have emerged as a safe haven for investors looking at them for self-use or investment post-pandemic owing to their liquidity, faster appreciation and desire to customize their living space. For developers, plots generate quick cash flow as they involve faster sales and less upfront investment as compared to apartments.”

He further added, “The demand for plots was quite pronounced in tier II cities and top southern cities, namely Bengaluru, Hyderabad and Chennai. As demand for apartments/floors/villas has shown some signs of weakness in the first half of 2025, the shift of investment towards plots is very likely going forward. Bengaluru in tier I, and tier II cities like Indore, Raipur, Coimbatore and Mysore have seen robust price escalation in 2024.”

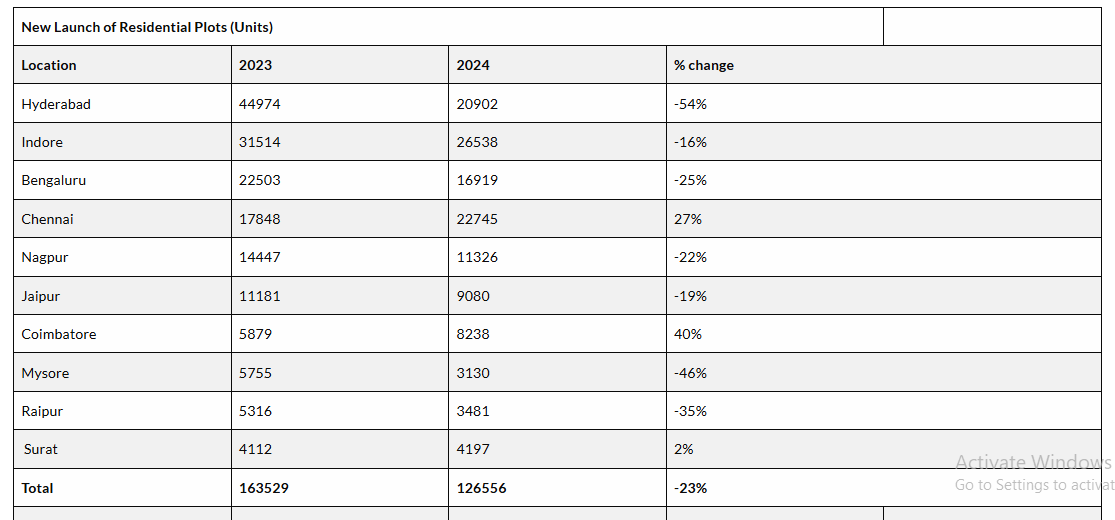

However, the report further highlighted that the supply of residential plots in the top 10 tier I & II cities fell 23% Y-o-Y in 2024 to 1,26,556 plots after recording 24% Y-o-Y growth in 2023 to 1,63,529 plots.

Three cities saw a rise in supply in 2024, namely Chennai (27%), Coimbatore (40%) and Surat (2%). The other seven cities saw a fall in supply.

In volume terms, Indore topped the list with 26,538 residential plots launched in 2024, followed by Chennai and Hyderabad.

The weighted average launch price of residential plots in the top 10 tier I and tier II cities rose 27% YoY in 2024 to Rs 3679 per sq. ft. which translates to Rs 33,111 per sq. yard and Rs 39,586 per sq. mt.

The residential plot market has emerged as a strong investment avenue post-2022, supported by high liquidity, demand for custom housing, and quicker developer monetization. Despite a slowdown in supply during 2024, pricing trends and early 2025 launches suggest continued investor interest, particularly in tier II growth centers and key southern metros.