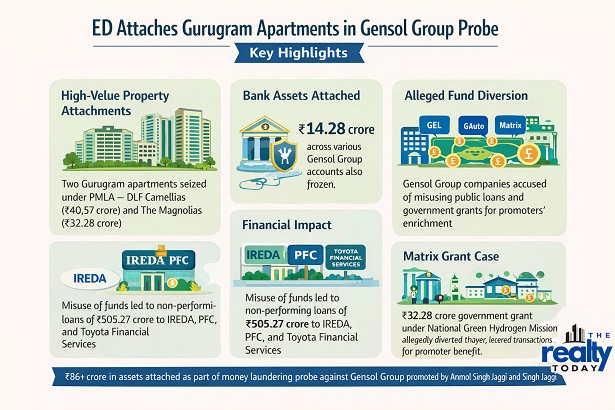

ED Attaches Gurugram Apartments in Gensol Group Probe- Key Highlights

- High-Value Property Attachments: Two Gurugram apartments seized under PMLA – DLF Camellias (₹40.57 crore) and The Magnolias (₹32.28 crore)

- Bank Assets Attached: ₹14.28 crore across various Gensol Group accounts also frozen

- Alleged Fund Diversion: Gensol Group companies (GEL, BluSmart, Go Auto, Matrix Gas & Renewables) accused of misusing public loans and government grants for promoters’ enrichment

- Financial Impact: Misuse of funds led to non-performing loans of ₹505.27 crore to IREDA, PFC, and Toyota Financial Services

- Matrix Grant Case: ₹32.28 crore government grant under National Green Hydrogen Mission allegedly diverted through layered transactions for promoter benefit

In its ongoing money laundering probe against the Gensol Group, the ED has attached assets over ₹86 crore in value, including two high-value apartments in Gurugram. This group, promoted by the brothers - Anmol Singh Jaggi and Puneet Singh Jaggi - is being investigated for allegedly diverting public funds for enrichment purposes.

The attached properties include:

- Apartment CM 706-A in DLF Camellias, registered under Capbridge Ventures LLP (a Gensol Group company), valued at ₹40.57 crore.

- Apartment 1516B in The Magnolias, DLF City Phase-V, registered under Anvi Power Investment Pvt Ltd, valued at ₹32.28 crore.

Additionally, the ED has attached bank balances worth ₹14.28 crore across various Gensol Group accounts under the Prevention of Money Laundering Act (PMLA).

The investigation covers multiple entities, including Gensol Engineering Ltd (GEL), BluSmart Fleet Pvt Ltd, Go Auto Pvt Ltd (GAPL), and promoters Anmol Singh Jaggi and Ajay Agarwal. The probe has been done because of two separate FIRs, one filed by Delhi Police against GEL and BluSmart, and another by the Central Bureau of Investigation (CBI) against Matrix Gas and Renewable Ltd (Matrix).

The ED alleged that GEL and BluSmart “collaborated with GAPL in a criminal conspiracy to systematically divert public funds disbursed as loans from public lenders - Power Finance Corporation (PFC) and Indian Renewable Energy Development Agency (IREDA) - and non-banking financial company Toyota Financial Services India Ltd under the guise of expanding their electric vehicle fleet.”

“These companies actually funneled these loans through GAPL and moved the same through a series of layered transactions across a web of group companies for the other business activities of Gensol Group and promoters’ personal enrichment,” the ED statement said.

The agency further explained the financial impact, “This diversion of loan funds has led to the accounts of Gensol becoming non-performing assets (NPAs) and caused a loss to the public sector units (IREDA and PFC) and to Toyota Financial Services India Limited. The total amount outstanding of GEL out of IREDA and PFC loans as on December 2025 is ₹505.27 crore.”

In the case of the DLF Camellias apartment, the ED alleged that Anmol Singh Jaggi, with co-conspirator Ajay Agarwal, diverted loan funds to acquire the property. Regarding the Matrix case, the ED noted: “This property [The Magnolias apartment] was acquired by Anmol Singh Jaggi (who was the chairman of Gensol Group) by utilizing the funds diverted from the group company - Matrix Gas and Renewables Ltd.”

The Matrix investigation began on the complaint of government enterprise MECON Ltd. The Ministry of New and Renewable Energy had allocated government grants under the National Green Hydrogen Mission (NGHM) for pilot projects in the steel sector. Matrix Gas and Renewables Ltd was the successful bidder, receiving 20% of the approved grant - ₹32.28 crore.

Instead of using the funds for the project, the ED alleges that the company “dishonestly and fraudulently diverted the entire amount through a series of layered transactions across a web of corporate entities under the control of Anmol Singh Jaggi, to conceal the source and finally utilized for the personal enrichment of the promoters and for other activities of Gensol Group.

The ED classified the two apartments as proceeds of crime, and therefore attached them under the PMLA.

The move is coming against the backdrop of increased regulations regarding cases of financial impropriety in high-end residential properties, especially where public funds and/or subsidized schemes are involved. The ED is also probing cases of fund flow and subsequent assets pertaining to the promoters and group companies.

Image source- enforcementdirectorate.gov.in