The National Real Estate Development Council (NAREDCO) has urged the central government to reduce the Goods and Services Tax (GST) on building materials to a uniform 18 per cent. The industry body made the appeal during the announcement of its upcoming 17th National Convention in New Delhi.

NAREDCO President G Hari Babu called for reforms in GST rates applicable to construction inputs and commercial leasing. He stated that the current taxation framework imposes a fixed 5 per cent GST on residential properties without input tax credit (ITC), and 1 per cent for affordable housing projects priced up to ₹45 lakh. However, he said the industry is requesting the affordable housing limit be raised to ₹60 lakh.

Mr. Babu also highlighted that key construction materials such as cement are taxed at 28 per cent, which increases project costs. “We want no GST on building materials to exceed 18 per cent. These are essential items, not luxury goods,” he said, emphasizing the need for a more rational and uniform tax regime to support the sector’s recovery and long-term planning.

GST on construction has long been seen as a challenge by industry stakeholders. The current system imposes multiple tax slabs depending on the material or service. While affordable housing enjoys concessional rates, the lack of ITC makes many projects less viable, especially those constructed for lease or rental purposes. Developers argue that the inability to claim ITC on commercial assets restricts capital efficiency and discourages investment in large-scale infrastructure and institutional real estate.

The NAREDCO convention’s curtain raiser event also saw remarks from Delhi Chief Minister Rekha Gupta. Addressing developers and industry leaders, she said that the Delhi government aims to remove a decade’s worth of infrastructure bottlenecks within the next two years. Gupta invited the private sector to participate in public-private partnerships (PPP) for constructing hospitals, schools, malls, and urban infrastructure. She assured policy and funding support for projects aligned with public goals.

Mr. Gupta stated, “We urge developers to bring forward PPP models that support the development of healthcare, education, and other key urban services. The government will ensure a conducive policy framework and financial backing.”

At the event, NAREDCO President Babu underlined the importance of long-term planning in real estate. He noted that the industry must take responsibility not only to meet current demand but to build in anticipation of future needs, including energy and resource efficiency. “The shift from short-term planning to goal-based development is essential,” he said.

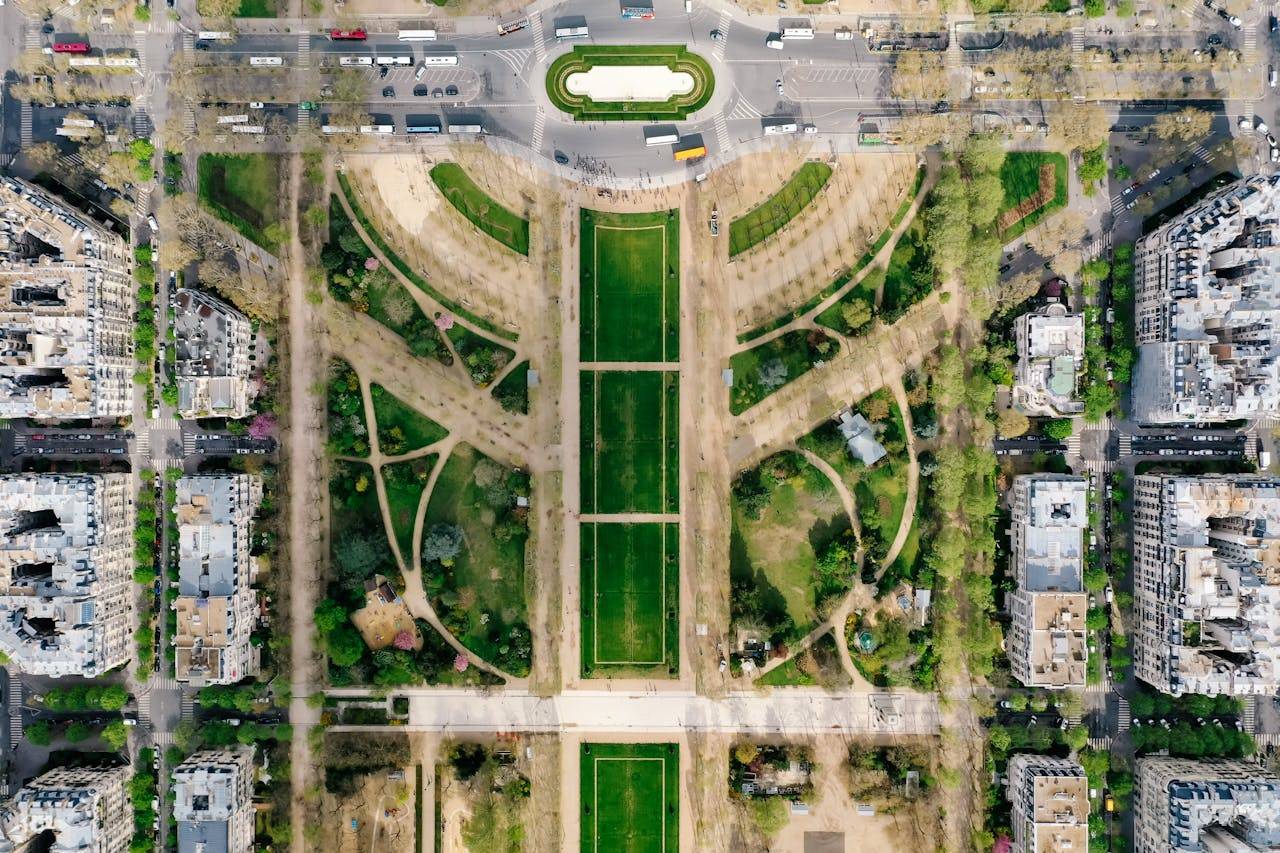

NAREDCO Delhi President Harsh Vardhan Bansal discussed how Delhi’s real estate landscape is evolving in response to demographic pressures and environmental limits. He pointed out that infrastructure needs in the capital are rising, but land availability and regulatory challenges continue to be major constraints.

“Delhi’s future growth depends on smarter development, not just more development,” Mr. Bansal said. “We are working with urban planners and policymakers to introduce sustainability-linked incentives and to discourage practices that are not future-ready.”

Mr. Bansal added that the council is advocating for policy tools that reward efficient energy use, waste management, and green construction practices. He noted that these measures are vital to building a city that can accommodate growth while minimizing environmental impact.

NAREDCO’s convention will focus on topics including urban planning, taxation policy, affordable housing, and sustainability frameworks for Indian real estate. The body aims to present policy recommendations to the government following the event, with the goal of creating a more balanced and efficient regulatory environment for developers and stakeholders.

The real estate sector has faced several challenges post-pandemic, including increased input costs, project delays, and financing constraints. Stakeholders argue that tax reforms, including rationalization of GST and restoration of ITC benefits, could help the sector recover faster and meet long-term national infrastructure targets.