UP Real Estate Market – 2025 Key Highlights

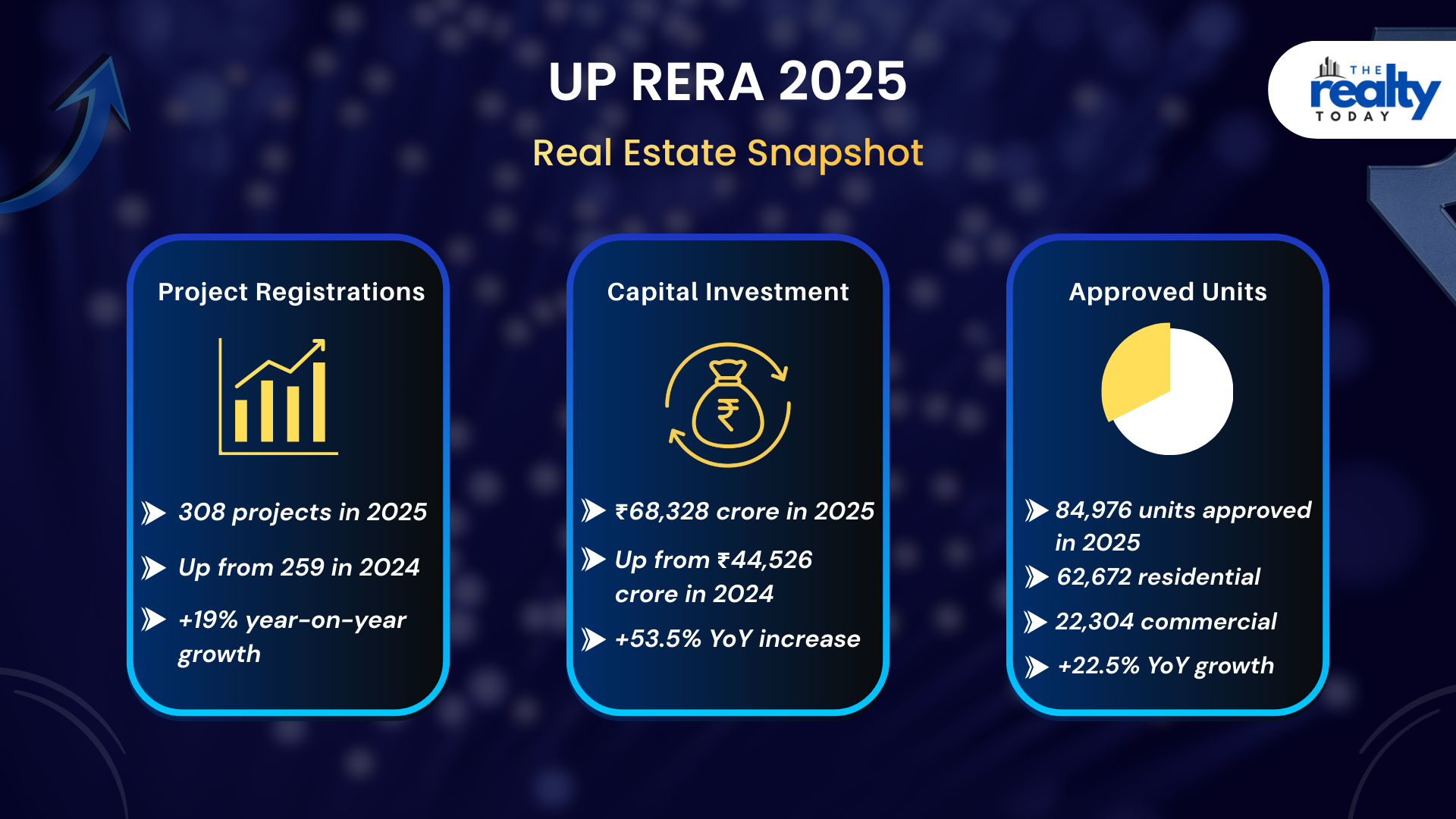

- Total Projects Registered: 308 (+19% vs 2024)

- Capital Investment: ₹68,328 crore (+53.5%)

- Approved Units: 84,976 (+22.5%) → Residential: 62,672 | Commercial: 22,304

- Top Performing Cities: Noida: 69 projects, ₹37,161 crore, 37,199 units, Lucknow: 67 projects, ₹9,398 crore, 13,668 units and Ghaziabad: 29 projects, ₹12,750 crore, 10,747 units

- NCR vs Non-NCR Projects: 122 NCR | 186 Non-NCR → tier-2 cities growing

- Religious & Pilgrimage Cities: Mathura 23, Ayodhya 5, Varanasi 9, Prayagraj 7

- Infrastructure Boost: Expressways, MRT, Smart Cities driving demand

Uttar Pradesh's real estate market showed an encouraging performance in the year 2025, with an increase of 19% in the registration of projects and an increased investment of 53.5% as compared to the previous year, according to the latest report released by the Uttar Pradesh Real Estate Regulatory Authority [UP RERA]. This increase is majorly driven by the Noida region and the other NCR districts, while the 2nd tier cities and religious spots also experienced an encouraging increase, which marks a trend of diversification of the state.

According to this report, a total number of 308 real estate projects have been registered in Uttar Pradesh in 2025, increasing from 259 in 2024 to register a rise of 49 projects. The capital investments in real estate projects that have been registered rose to ₹68,328 crore in 2025 from ₹44,526 crore in 2024.

Noida leads in registrations, units and investments

Noida performed with a lead of 69 projects in 2025 and accounted for 37,199 approved residential and commercial units. The investment value was also led by the state, with Noida at ₹ 37,161 crores, showcasing further the leading position it continues to occupy within Uttar Pradesh's real estate.

Lucknow was a close second in the number of registered projects with 67 projects comprising 13,668 approved units, and Ghaziabad also saw 29 projects comprising 10,747 units. In terms of investment, Ghaziabad stood second with ₹12,750 crore, followed by Lucknow at ₹9,398 crore.

The report underlines that NCR districts still lie at the heart of driving large-scale investments in residential, mixed-use, and commercial developments on the basis of strong end-user demand and infrastructure-driven growth.

Approved units increase 22.5% in 2025

The number of approved residential and commercial units in the state is up from 69,365 units in 2024 to 84,976 units in 2025, indicating an increase of 22.5% or addition of 15,611 units in just one year. Of these units approved for 2025, 62,672 units were residential units in form of apartments, plots, and villas, while 22,304 units were commercial units in form of shops, studios, and other commercial premises.

In the last two years taken together, a cumulative number of 1,54,341 residential and commercial units has been approved by UP RERA. There are various options available for buyers as a result.

Infrastructure drive spurs investors' confidence

According to a report, large-scale development projects in infrastructure have been important in fueling real estate development. Expressways, MRT projects, industrial corridors, Smart Cities, and urban renewal projects have transformed connectivity and livability, making established urban centers, as well as emerging urban centers, more attractive to real estate investment.

"The Authority performance in 2025 epitomises the transparent, accountable and consumer-friendly performance ", said Sanjay Bhoosreddy, Chairman, UP RERA. He said this indicates increased trust in the regulatory framework while maintaining regional balance, timely completion of projects, and safeguarding the interests of homebuyers through a series of increased project registrations, approved units, and capital investment.

The expansion continues even beyond the NCR

Although the NCR districts have continued to show a substantial number of projects, there is evidence of the trend shifting to non-NCR districts, according to the report. In 2024, out of the 259 projects registered with the UP RERA, 89 projects belonged to the NCR region, whereas 170 projects belonged to non-NCR districts. This trend did not remain the same even in 2025, with 122 projects belonging to the NCR districts and 186 projects belonging to non-NCR districts.

The increase in the share of non-NCR registrations reflects the influence of infrastructure development activities initiated by the government in Tier-2 cities as well as emerging cities, as stated in the report.

In the non-NCR areas, Lucknow proved to be a significant driver of growth with 67 registered projects in 2025. Mathura came in second with 23 projects because of the rise in demand associated with religious tourism. Bareilly had 15 projects, and Agra had 14 project registrations.

Regional Division: West, Central and East UP

Projects sanctioned by the Western UP RERA, for example, increased to 175 in 2025, with a project value of Rs. 55,620.43 crores and consisting of 60,214 units.

Noida, Ghaziabad, and Agra were the top three districts based on the percentage of total investment against the approved projects. Districts such as Aligarh, Bulandshahr, Firozabad, Hapur, Mathura, Meerut, Moradabad, and Muzaffarnagar also form part of this growth.

The new projects along with an investment of Rs 11, 270.42 crores, 104 projects to be approved, 21, 646 units to be made were experienced by the region. Jhansi and Kanpur Nagar were the next in the list whereas Lucknow was the first city to be followed.

New projects were also undertaken in districts such as Barabanki, Bareilly, Rampur, Shahjahanpur, and Unnao.

In the eastern part, 29 projects owned by UP RERA involved an overall investment of Rs. 1, 436.86 crores. It means about 3, 116 units are to be made. The first three cities in investment value were Varanasi, Gorakhpur, and Ayodhya, whereas Prayagraj, Mirzapur, Mau, Chandauli, and Gonda were other cities having projects registered.

Religious cities record increased activity

There is also an increase apparent in the real estate sector in religious and pilgrimage centers, having arisen from a rise in economic activity stemming from tourism and improved infrastructure. Ayodhya registered five projects in 2025, representing continuous investor interest aligned with the increased national importance of the city.

Mathura was identified as a significant node, boasting 23 projects, which were mainly driven by demands in the residential, hospitality, and commercial sector. Varanasi had nine projects, which were driven by redevelopment work taking place in the city, apart from it being a significant spiritual destination. Prayagraj had seven projects, which marked a revival in confidence in its future.

The performance assessment of the UP RERA in 2025 clearly shows that Uttar Pradesh is now in a phase of increased confidence, participation, and transparency in its real estate market. The increased number of project enrollments and investment inflows shows that developers feel comfortable investing huge amounts in this market with increased trust in demand as well as stability.

The segment is also more participatory and geographically diversified. Project activity is not limited to NCR. Tier 2 and developing cities are seeing more activity. And opportunities have also been generated due to better infrastructure, connectivity, and focused development of cities such as Lucknow, Mathura, Ayodhya, and Varanasi. This is crucial as it not only reduces risks of concentration but also ensures that there is strength and resilience in the realty market of the state.

At the same time, a crucial aspect of the matter is the focus on transparency as well as accountability. The increase in the number of registrants under UP-RERA indicates that the developers are operating in a more organized setting, while the buyers too are reaping the benefits. In effect, the policies have managed to bring a positive impact of discipline instead of speculative development.

On a whole, what is observed in 2025 is a real estate landscape in Uttar Pradesh which is gradually taking shape, getting more credible, and ready to attract investments, providing a stable base for sustainable urban expansion.

Image source- moneycontrol.com

.png)