The sales in India’s top 9 cities dropped to 98,019 units in Q4 2025, registering a decline of 16% year-over-year, which is the lowest sales figure since the sales in Q3 2021, as per PropEquity report. Though the decline in sales was seen in all major cities, indicating that buyers are becoming increasingly choosy and are opting for projects in the premium as well as value segment, Navi Mumbai and Delhi-NCR bucked the trend by registering an increase of 13% and 4%, respectively, which indicates that some micro-markets, with their infrastructure, connectivity, and quality of life, are continuing to attract buyers. The other seven cities saw sales decline by as much as 31%, which indicates that projects with greater value and quality are replacing volume sales. This indicates the changing tastes of buyers and an increased maturity of the India’s top cities’ housing market.

On QoQ basis, housing sales fell 2% in Q4 2025.

Samir Jasuja, Founder & CEO, PropEquity stated, that traditionally, the October-December period records strong sales momentum and new launches driven by the festive season. However, the recent decline reflects a shift toward premiumisation in the market, as evidenced by value growth despite a contraction in volumes. This trend has been continuing from 2024. "

For instance, in 2023, approximately 4.81 lakh units were launched with a total value of ₹6.3 lakh crore. In contrast, 2024 saw the launch of 4.11 lakh units - around 70,000 fewer units - yet with a higher aggregate value of ₹6.8 lakh crore.

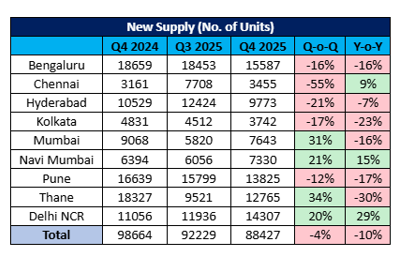

Housing supply fell 10% YoY to 88,427 units in Q4 2025 with only Delhi NCR (29%), Navi Mumbai (15%) and Chennai (9%) recording growth. Other 6 cities saw decline in supply up to 30%.

On QoQ basis, housing supply fell 4% in Q4.

On the year ahead, Mr.Jasuja further said, that the outlook is more positive, supported by a low base in 2025. We remain confident about the market’s trajectory. Significant funds raised by developers in 2025 are expected to translate into increased project launches in 2026. The market continues to offer substantial growth potential. Improved transmission by banks of the cumulative 125 bps repo rate reduction could lead to lower home loan rates, further supporting demand. Additionally, the government’s proactive stance remains a key positive.

While sales in the top cities of India witnessed a decline in Q4 2025, the market has continued to reflect a resilient and changing face. Premiumisation as reflected by the increase in average prices indicates that volume is no longer the game; quality and value are what buyers increasingly desire. With good funding raised by the developers in 2025, sustained government support, and the possibility of lower home loan rates through better transmission of the repo rate cuts, 2026 appears promising.

.png)