India’s real estate sector is experiencing a major inflection point, driven by a surge in institutional participation and unprecedented deal activity. The July–September 2025 quarter marked a historic phase for the industry, with 42 transactions worth $2.9 billion, making it the highest-ever quarterly investment in the country’s property market. This data, compiled by Grant Thornton Bharat, highlights how rapidly India’s real estate landscape is evolving into a mature, institutionalised ecosystem, where transparency, governance, and yield-driven assets are increasingly becoming the norm.

A Quarter That Reinstated Investor Confidence

The July–September period saw a remarkable confluence of capital across mergers and acquisitions (M&A), private equity (PE), and capital markets. Industry analysts attribute this momentum to growing investor confidence in the sector’s earnings stability and regulatory clarity.

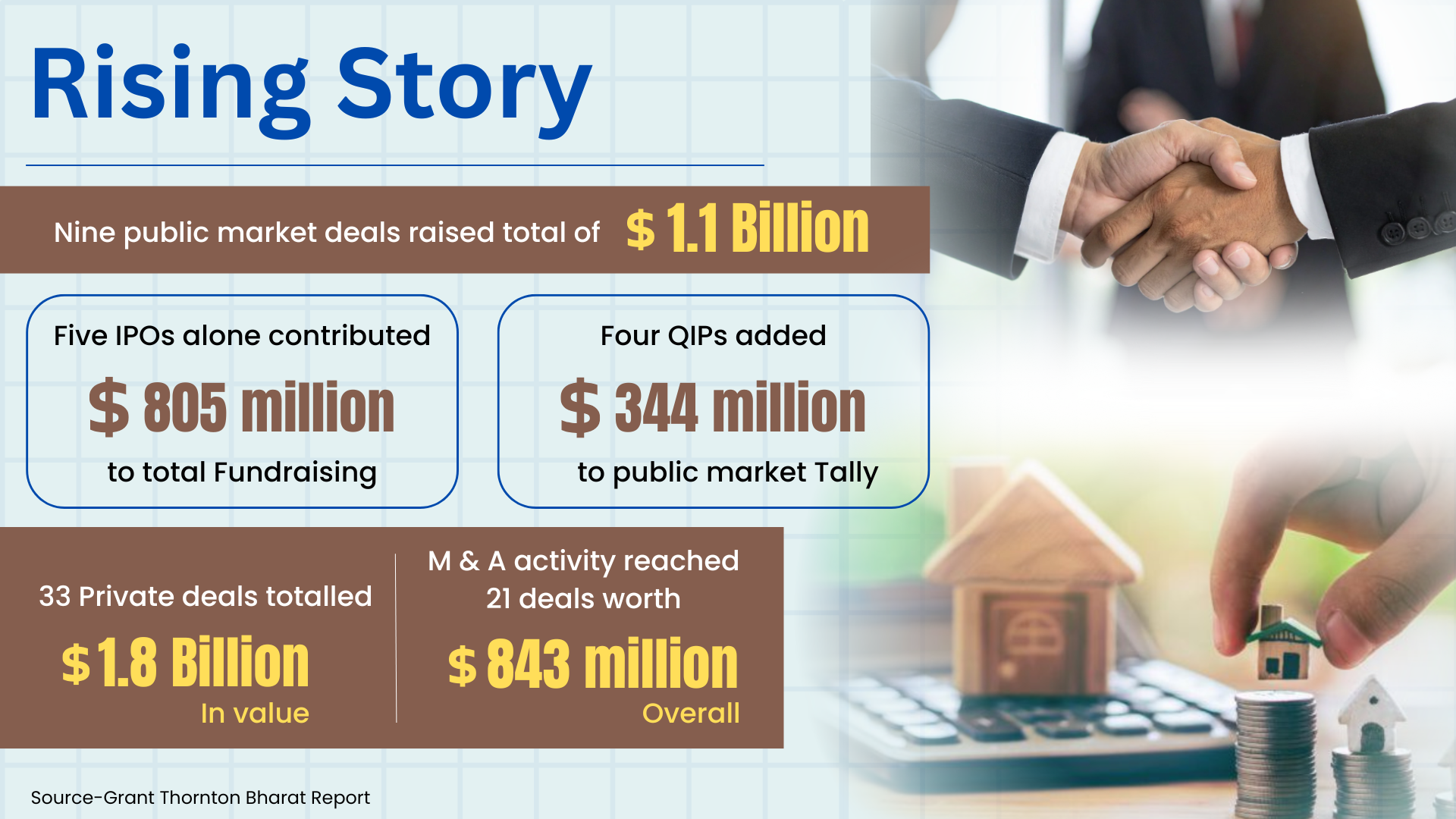

According to Grant Thornton Bharat, the quarter witnessed nine public market transactions—comprising five initial public offerings (IPOs) and four qualified institutional placements (QIPs)—alongside 33 private deals worth $1.8 billion. Together, they signalled a sharp rebound in investor activity following a brief period of consolidation earlier this year.

“This quarter marks a turning point for India’s real estate sector, showcasing strong performance across M&A, private equity, REIT, and IPO segments,” said Shabala Shinde, Partner and Real Estate Leader at Grant Thornton Bharat. “The surge in marquee transactions and investor appetite for income-generating, institutional-grade assets reflect the sector’s growing depth and resilience.”

Domestic Deals and REITs Lead the Way

Domestic M&A activity dominated the landscape, accounting for 21 transactions valued at $843 million, of which $838 million were homegrown. Notable among these was The Phoenix Mills Ltd’s acquisition of Island Star Mall Developers, a move that strengthened its retail portfolio. Similarly, Mindspace REIT’s acquisition of The Square represented a milestone — its first third-party purchase since listing, underlining the growing maturity and confidence in India’s REIT ecosystem.

REITs (Real Estate Investment Trusts) have increasingly emerged as a preferred instrument for investors seeking regular income and stable returns. Their rising prominence has helped channel institutional capital into India’s office and retail assets, further formalising the market.

Private equity inflows made a significant comeback during the quarter, with 12 deals worth $859 million, marking a 71% rise in volume and a 48% increase in value compared to the previous quarter. Commercial real estate and proptech (property technology) segments attracted the lion’s share of this capital.

Among the standout investments was Prime Offices Fund’s $290 million infusion into RMZ One Paramount, signalling continued investor faith in India’s office space segment despite hybrid work trends. Analysts note that investors are now more focused on income-yielding, Grade-A assets located in growth corridors such as Bengaluru, Pune, and Gurugram.

Capital Markets Boost Sector Liquidity

The public market also witnessed a resurgence. Five IPOs collectively raised $805 million, while four QIPs contributed another $344 million, enhancing liquidity and visibility for listed real estate entities. Knowledge Realty Trust’s IPO, which raised $547 million, accounted for nearly 68% of total capital raised via public markets in the quarter, highlighting strong investor appetite for well-governed real estate platforms.

According to Chintan Sheth, CMD of Sheth Realty, India’s property market is clearly transitioning toward an institutional and yield-driven model. “Investors now prefer structured, income-generating opportunities backed by stronger governance, transparency, and regulatory clarity. Improved capital access and proptech adoption are making the sector more efficient, data-driven, and accountable,” he said.

This trend is visible in the growing investor preference for commercial and retail assets that offer predictable income streams. Real estate technology and consultancy firms also witnessed rising deal activity, reflecting the sector’s diversification beyond traditional construction-led models.

Residential Segment Slows, but Tech Gains Traction

While the commercial segment and REITs took centre stage, residential real estate saw relatively muted investor activity during the quarter. Developers, however, are optimistic that sustained end-user demand, favourable interest rates, and festive season launches will keep the segment stable.

On the other hand, real estate technology — including proptech startups focusing on digital transactions, facility management, and data analytics — recorded notable gains in both deal count and value. This indicates how technology is becoming integral to how real estate is financed, developed, and operated in India.

With a stronger regulatory framework, maturing REIT ecosystem, and a rising base of domestic institutional investors, the sector is poised for sustained capital inflows. Experts believe this institutionalisation wave will help Indian real estate withstand global economic uncertainties and cyclical slowdowns. As investors increasingly seek governance-driven, transparent, and yield-oriented assets, India’s property market is moving firmly into a new era — one defined by professionalism, accountability, and long-term value creation.

Image- freepik.com

.png)