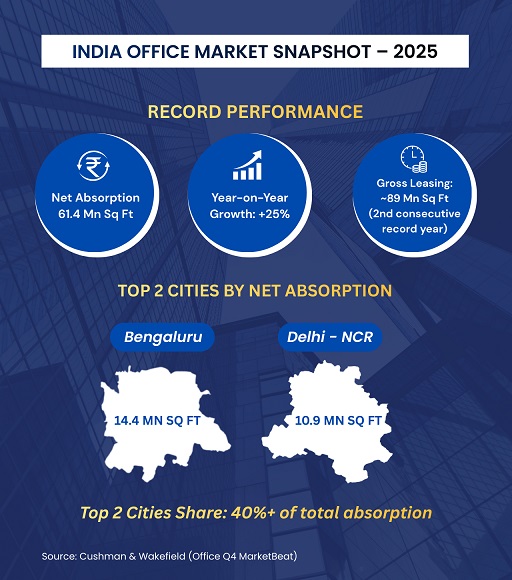

Cushman & Wakefield Office Q4 MarketBeat Report 2025 – Key Highlights

- Record absorption: 61.4 mn sq ft, 25% YoY growth – strongest ever.

- Top cities: Bengaluru (14.4 mn), Delhi NCR (10.9 mn) – together >40% of total absorption.

- Demand shift: Companies prefer Grade-A, sustainable, tech-ready offices with flexible layouts.

- Emerging hubs: Noida–Greater Noida and Gurugram micro-markets seeing strong traction.

- Leasing trends: Gross leasing ~89 mn sq ft; longer-term commitments reflect market confidence.

India office real estate industry has registered the strongest performance ever in 2025, with net absorption standing at a record high of 61.4 million square feet, marking a year-over-year improvement of 25%, according to Cushman & Wakefield's Office Q4 MarketBeat Report. This shows that there is a revival in occupier confidence fueled by a stable economy and increased importance to global business teams.City-wise Absorption Trends

Amongst these eight major cities, Bengaluru recorded the highest total absorption of 14.4 million sq ft, followed by Delhi NCR with a total absorption of 10.9 million sq ft, thereby constituting more than 40% of the total absorption. The remaining eight major cities of Mumbai, Hyderabad, Pune, and Chennai also recorded healthy numbers in terms of absorption levels for leases. The highest growth in terms of year-on-year change has been registered by Chennai and NCR.

NCR Continues to Anchor Office Demand

Commenting on NCR’s performance, Sandeep Chhillar, Founder and Chairman, Landmark Group, said, “Gurugram continues to anchor NCR’s office market with its infrastructure, talent access, and corporate ecosystems. What’s notable today is the nature of demand: occupiers are committing earlier and for longer durations, especially in Grade-A assets that meet global benchmarks. The city’s emerging micro-markets are witnessing steady absorption even as new supply remains measured. This balance is what will push occupancy levels higher over the next two years. The market has moved from reactive leasing to strategic space planning, which is a strong indicator of sustained momentum.”

This shift towards longer-term commitments highlights occupiers’ confidence in market stability. Measured supply additions, combined with steady demand, are helping maintain healthy vacancy levels. Gurugram’s evolving micro-markets continue to benefit from infrastructure upgrades and strong corporate ecosystems.

India Strengthens Its Position as a Strategic Business Base

Ishwin Singh Hora, Director, Reach Group, said, “An annual growth of 25% in office space and a record absorption of 61.4 million sq ft clearly indicate that companies increasingly view India as a long-term strategic business destination. Among cities, Bengaluru recorded the highest absorption, followed by Delhi NCR, while key markets such as Mumbai, Hyderabad, Pune and Chennai also witnessed strong leasing activity. In particular, the sharp rise in net absorption in Chennai and Delhi NCR underscores the strengthening fundamentals of the office market. In the NCR, especially Gurugram, demand for Grade-A office space remains robust, driven by the growing presence of multinational companies, global capability centres and the BFSI sector. Superior connectivity, strong infrastructure and offices designed to prioritise employee experience are emerging as the first choice for occupiers. We are confident that this trend will continue to keep the office market stable, mature and growth-oriented in the coming years.”

The continued expansion of GCCs and multinational firms is reshaping office demand across metros. Occupiers are increasingly prioritising quality, connectivity, and employee experience over cost alone. This evolution is lending long-term maturity and resilience to India’s office market.

Noida–Greater Noida Emerges as a High-Growth Corridor

Sharing insights on emerging office destinations, Dr Amish Bhutani, Managing Director, Group 108, said, “The fact that the Indian office market has reached a record level of 61.4 million sq ft with a YoY growth rate of 25% is a manifestation of the growing confidence and importance of India on the global business landscape. In Noida- Greater Noida, this is being fueled by the growing demand for office space retention by GCCs, tech companies, and the expansion plans of domestic companies. Grade-A offices, especially those located along the Noida- Greater Noida expressway and near the Noida International Airport, are registering a growing demand due to occupiers' interest. Thus, we foresee that this increase in demand will ensure that the office market remains resilient and geared for the future.”

Infrastructure-led development is accelerating Noida–Greater Noida’s transformation into a strategic office hub. Proximity to expressways and the upcoming international airport is improving accessibility and occupier interest. The region is increasingly being viewed as a long-term alternative to traditional NCR office locations.

Grade-A Offices Drive Structural Shift in Demand

Sonakshi Wadhwan, CBO (Office Transactions), Rise Infraventures, said, “The office market absorption is not merely a sign of recovery, but a clear indication that companies are viewing India as a long-term business base. Expansion by IT, BFSI, engineering firms, and especially GCCs has reshaped the demand for office space. Today, occupiers are prioritising office spaces that are technology-ready, offer large floor plates, and provide flexibility for future expansion. This shift has led to increased investment in Grade-A office developments, with quality projects consistently receiving strong responses. This structural shift will make office real estate market more stable, organised, and sustainable in the coming years.”

This preference for future-ready offices is encouraging developers to focus on quality over volume. Sustainability features, digital infrastructure, and flexible layouts are becoming standard expectations. As a result, Grade-A assets are consistently outperforming older office stock.

Broad-Based Momentum Across Markets

Reinforcing the national trend, Salil Kumar, Director – Marketing and Business Management, CRC Group, said, “The data clearly tells that India’s office market momentum is real and broad-based. With over 61 million sq ft of net absorption in 2025, we’re seeing occupiers commit with far greater confidence. In Noida and Greater Noida, this is translating into strong traction from GCCs and multinational firms looking for scalable, Grade-A workspaces. Besides, the region’s value proposition has evolved rapidly, shaped by the upcoming Noida International Airport, expressway connectivity, and metro expansion. Hence, Noida-Greater Noida is increasingly being viewed as a long-term strategic office destination, not just within NCR, but in the national office market narrative.”

Leasing-related levels of confidence indicate a visibility of demands that are likely to continue in a certain manner. Infrastructure-related growth corridors are increasingly being identified as sectors that are likely to benefit from such demands.

The gross leasing volumes for 2025 were around 89 million sq ft, which is the second successive year where leasing volumes registered a record high. Leasing demand came mostly from IT-BPM, GCCs, BFSI, engineering, and shared workplace associations, who mostly preferred Grade A, sustainable, and employee-focused offices. In terms of overall lettings activity across the larger markets, there is a clear indication that the office market is healthy and well-prepared for future growth.

.png)