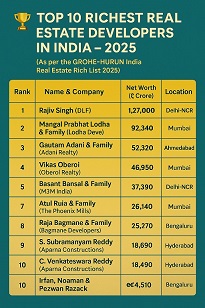

In the latest Grohe-Hurun India Real Estate Rich List 2025, Rajiv Singh, Chairman of DLF, has been named the richest real estate developer in India, with a personal and family wealth estimated at ₹1.27 lakh crore. Singh retains his top position in the annual listing that tracks the net worth of India's leading real estate promoters and families. The list reflects the shifts and consolidations taking place within the Indian property development landscape amid post-pandemic recovery and urban expansion.

At the second position is Mangal Prabhat Lodha and family of Lodha Developers (Macrotech Developers), with a wealth of ₹92,340 crore, followed by Gautam Adani and family of Adani Realty, whose real estate wealth stands at ₹52,320 crore. While Adani’s overall group wealth spans multiple industries, the ranking only accounts for the portion derived from real estate ventures.

Bengaluru Dominates Top 10

According to the Grohe-Hurun report, of the top 10 individuals and families, four hail from Bengaluru, marking the southern tech capital as a rising powerhouse in real estate development. Mumbai follows with three representatives, while Hyderabad and Delhi-NCR each have two. Ahmedabad, represented solely by Adani Realty, completes the list.

In the fourth position, Vikas Oberoi of Oberoi Realty has amassed ₹46,950 crore. Basant Bansal and family of M3M India, based in Gurugram, stand fifth with ₹37,390 crore.

Atul Ashokkumar Ruia and family of The Phoenix Mills secured the sixth spot with ₹26,140 crore. Raja Bagmane and family, from Bengaluru-based Bagmane Developers, are seventh with ₹25,270 crore. S Subramanyam Reddy and C Venkateswara Reddy of Aparna Constructions and Estates, based in Hyderabad, ranked eighth and ninth respectively, with ₹18,690 crore and ₹18,490 crore.

The tenth position is shared by Irfan Razack, Noaman Razack, and Rezwan Razack, all from Prestige Estates Projects, with a wealth of ₹14,510 crore each.

Top Gainers in 2025

Among the top gainers this year, Raja Bagmane posted the highest percentage growth, reflecting strong commercial leasing and institutional project momentum in Bengaluru’s Outer Ring Road corridor. He was followed by Atul Ruia of Phoenix Mills, driven by sustained retail expansion and mixed-use developments, and Vikas Oberoi, who reported a 5% rise in wealth due to premium residential and hospitality segments.

Leading Developers by Area Constructed

On the operational front, DLF leads the country with a cumulative 349 million square feet developed. Godrej Properties stands second with 223 million sq ft, and Prestige Estates Projects third with 180 million sq ft. Other developers in the top six by area include SOBHA (136 million sq ft), BL Kashyap & Sons (125 million sq ft), and Lodha Developers (100 million sq ft).

Top Developers by Area Constructed

- DLF: 349 million sq ft

- Godrej Properties: 223 million sq ft

- Prestige Estates Projects: 180 million sq ft

- SOBHA: 136 million sq ft

- BL Kashyap & Sons: 125 million sq ft

- Lodha Developers: 100 million sq ft

Most Valuable Real Estate Companies

The Grohe-Hurun India Real Estate 150 also released its parallel ranking of the most valuable real estate firms in India by market capitalization and estimated enterprise value. The total value of the companies on the list reached ₹16 lakh crore, up by ₹1.9 lakh crore over the previous year.

DLF was ranked as the most valuable real estate developer, with a valuation of ₹2.07 lakh crore, followed by Lodha Developers at ₹1.38 lakh crore and Indian Hotels Company (IHC) at ₹1.08 lakh crore. Notably, IHC recorded the highest absolute gain in value this year, adding ₹29,150 crore.

Prestige Estates Projects ranked fourth with ₹71,500 crore, Godrej Properties fifth at ₹70,600 crore, Oberoi Realty sixth with ₹69,400 crore, and Phoenix Mills seventh at ₹55,900 crore. Adani Realty, with a valuation of ₹52,400 crore, ranked eighth and remains India’s most valuable unlisted real estate firm.

Most Valuable Real Estate Companies (2025)

- DLF: ₹2.07 lakh crore – most valuable

- Lodha Developers: ₹1.38 lakh crore – 2nd

- Indian Hotels Company (IHC): ₹1.08 lakh crore – 3rd

- Prestige Estates: ₹71,500 crore – 4th

- Godrej Properties: ₹70,600 crore – 5th

- Oberoi Realty: ₹69,400 crore – 6th

- Phoenix Mills: ₹55,900 crore – 7th

- Adani Realty: ₹52,400 crore – most valuable unlisted firm

Sector Sees Broader Participation

The report highlighted the entry of 63 new companies, with 29 debuting directly into the Top 100. This indicates growing investor participation and a wider base of leadership across India’s real estate ecosystem. OYO, led by Ritesh Agarwal, made its first appearance on the list, debuting in the Top 15, based on its real estate holdings and portfolio-led hospitality model.

Debt Reduction Among Developers

Some developers made progress in reducing debt, often seen as a sign of financial stability in a capital-intensive sector. Oberoi Realty reduced its debt by ₹1,449 crore, bringing the total to ₹2,495 crore. Lodha Developers followed, trimming ₹1,363 crore, now carrying ₹7,698 crore in total debt. Juniper Hotels, Omkar Realtors, and Bagmane Developers also made it to the top five in debt reduction.

Top Debt Reducers

- Oberoi Realty: Debt cut by ₹1,449 crore (now ₹2,495 crore)

- Lodha Developers: Reduced by ₹1,363 crore (now ₹7,698 crore)

- Others: Juniper Hotels, Omkar Realtors, Bagmane Developers

City-wise Concentration

Mumbai continues to dominate the sector’s power map, with 42 companies featured on the list, an increase of nine from the previous edition. Bengaluru follows with 23 companies, New Delhi with 16, and Hyderabad and Pune with 13 each. Collectively, these five cities account for over 70% of the list, highlighting the regional concentration of India’s real estate market.

Industry Outlook

The Hurun report acknowledged that the sector’s overall growth rate slowed to 14%, compared to 70% last year. However, 61% of the companies still reported valuation gains, suggesting resilience amid macroeconomic pressures such as global conflicts and commodity price volatility. The report credited a sharp recovery post-April 2025 for mitigating early losses.

According to Anas Rahman Junaid, Founder and Chief Researcher of Hurun India, the sector is exhibiting "renewed structural depth" as institutional confidence returns, driven by factors like cooling cement prices, easing tariffs, and an anticipated cut in repo rates. The report underlines a stabilizing phase in Indian real estate, with top players consolidating, new entrants growing, and investors regaining confidence, particularly in rental housing, mixed-use developments, and asset-light models.

Image source- dlfindia.in