In recent years, India has emerged as a prime destination for global organizations to establish their operations, whether to optimize costs or tap into the country’s growing domestic market. According to Vestian Research, India currently hosts over 1,750 GCC companies with nearly 3,800 bases, resulting in a demand for more than 40% of the total office space over the past two years. To capitalize on the rising demand, flex operators, with their ability to respond quickly to evolving business needs and dynamic growth trajectories, have positioned themselves as strategic partners for businesses across various stages of growth. As per Vestian’s report, more than 475 out of the 1,400 flex centers across major Tier-1 cities currently host GCC bases.

GCCs Catalyse Green and Grade-A Adoption in Flex Spaces

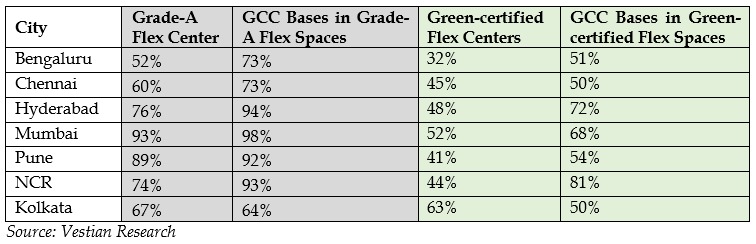

As GCCs are becoming the major occupiers of flex spaces, they are driving sustainability and quality grade-A office leases in the flex segment. Across the top seven cities, 42% of flex centres are green-certified, and 69% are located in premium grade-A buildings. In comparison, 62% of GCC bases operating within flex spaces are located in green-certified centers, while an even higher 85% function from grade-A buildings.

City-wise Distribution of Grade-A and Green-Certified Centers

Peripheral Business Districts (PBD) have emerged as preferred locations for GCC expansion compared to central city areas. These zones offer strong connectivity, competitive pricing, better scalability, and larger office campuses—factors that appeal to rapidly growing global enterprises. Reflecting this shift, 77% of the flex area occupied by GCC bases is located in peripheral regions, compared with 61% of the overall flex stock.

Shrinivas Rao, FRICS, CEO, Vestian said, “As India’s GCC landscape continues to evolve, flex operators will remain indispensable partners—offering flexibility, faster speed to market, and enterprise-grade infrastructure that global companies require, to scale efficiently in a highly competitive market.”

India’s Flex Market Scales Rapidly on GCC Demand

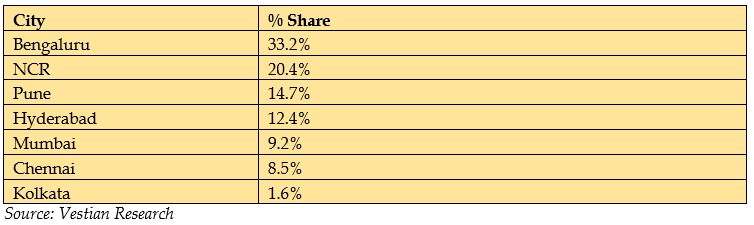

Driven by strong demand from GCCs, India’s flex ecosystem has expanded to 82.3 Mn sq ft spread across nearly 1,400 centres in the top seven cities. However, the market continues to remain consolidated, with the top 10 operators controlling 67% of the total stock. Bengaluru leads with 33.2% share of the country’s flex stock, followed by NCR at 20.4% and Pune at 14.7%.

City-wise Distribution of Flex Stock

Rao further added, “India’s flex stock is projected to exceed 100 Mn sq ft across Tier-1 cities by 2026 as flex operators expand and upgrade their portfolios to effectively accommodate the growing demand from Global Capability Centers .”

Underpinned by resilient economic fundamentals, stable policy frameworks, and anticipated GDP growth of over 7% in FY 2026, India is well-positioned to cement its role as a leading global hub for GCCs. As these centers continue prioritizing the need for agility, sustainability, and regulatory compliance, flex operators have an opportunity to align their offerings with the next generation's workspace expectations.

.png)