Luxury independent floors in South Delhi have seen a significant appreciation in value over the past three years, with prices rising by as much as 105%, according to a market analysis released by the Golden Growth Fund (GGF), a Category-II real estate-focused Alternative Investment Fund (AIF). The report attributes the surge to sustained demand from end-users and rising interest from investors, particularly ultra-high-net-worth individuals and startup entrepreneurs seeking privacy, space customisation, and strategic location.

100%+ Growth in Premium Floors

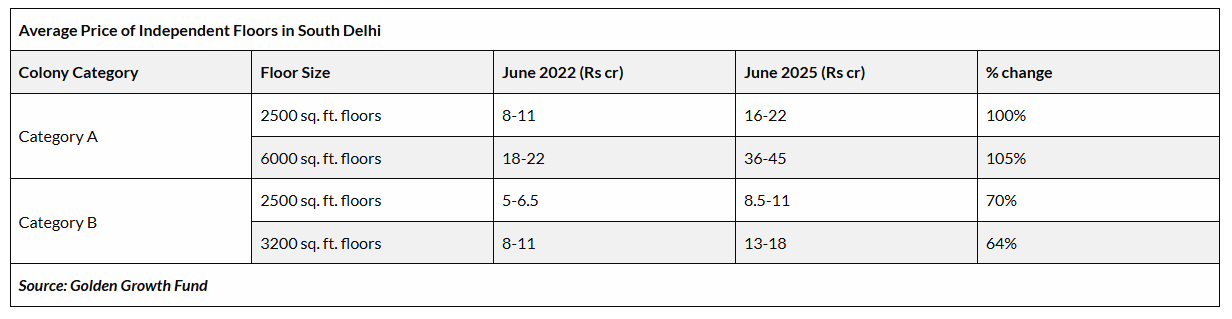

According to GGF’s data, the most notable price escalation has occurred in Category-A colonies, where 6,000 sq ft floors that were priced between ₹18 crore and ₹22 crore in June 2022 now command between ₹36 crore and ₹45 crore in June 2025. This represents a 105% increase in value over the three-year period.

Smaller 2,500 sq ft floors in the same premium localities have appreciated by approximately 100%, with prices rising from the ₹8–11 crore range to ₹16–22 crore.

In Category-B colonies, the growth is slightly more moderate. A 2,500 sq ft floor that cost ₹5–6.5 crore in 2022 is now valued at ₹8.5–11 crore—a 70% rise. Similarly, 3,200 sq ft floors that were priced between ₹8 crore and ₹11 crore have increased to ₹13–18 crore, reflecting a 64% gain.

What’s Fueling the Surge?

Ankur Jalan, CEO, Golden Growth Fund said: “South Delhi is today the most premium real estate market with per sq. ft. rate in a Cat-A colony ranging between Rs 60,000-Rs 90,000 and in Cat-B colony between Rs 36,000-Rs 56,000 depending upon floor and colony. With growing interest from startup founders and businessmen, South Delhi has emerged as an end-user destination with privacy and customised space as primary needs of these ultra-rich habitants. Its connectivity to the office hubs in Gurugram and Noida; and the airport adds to its appeal. The excellent return on investment is another factor that has added to the growing interest.”

Beyond the appeal of location and lifestyle, the sharp escalation in prices is also being driven by the promise of strong returns on investment. Over the past three years, the real estate market has remained bullish, but South Delhi stands apart due to its consistent demand, perception as a safe and reliable investment, and the substantial returns it offers. Moreover, the area continues to be regarded as secure against capital depreciation, reinforcing investor confidence.

South Delhi’s ongoing appeal stems from its blend of exclusive residential colonies, proximity to office hubs in Gurugram and Noida, and ease of connectivity to Indira Gandhi International Airport and major arterial roads. This connectivity has especially attracted startup founders and established business families who prioritise convenience and high-quality independent homes.

“South Delhi has emerged as a high-end end-user market, with privacy and customisation being key requirements of its residents. That’s a shift from investor-driven markets to user-driven purchases,” the GGF report observed.

Redevelopment Potential

The report also highlighted the massive redevelopment potential of South Delhi, pegging its value at ₹5.65 lakh crore. This figure is based on the current and latent development capacity across 42 MCD-regulated colonies, with plots in Category A and B colonies alone contributing ₹5.35 lakh crore to this potential.

This redevelopment value is seen as a key long-term factor sustaining South Delhi’s appeal, as older bungalows are increasingly being redeveloped into multiple independent luxury floors, catering to families across generations and investors seeking rental yield.

Rise in Structured Investment Through AIFs

Another trend noted in the report is the growing role of Alternative Investment Funds (AIFs) in channeling capital into South Delhi’s real estate market. Previously, HNIs, NRIs, and family offices invested in individual properties, often informally and without professional management.

Now, the emergence of structured real estate AIFs like Golden Growth Fund has made it easier for such investors to enter the market with compliance, risk mitigation, and managed returns. “With returns as high as 18–20% without the hassle of maintenance, AIFs have opened a new avenue for these investors,” Jalan explained.

GGF's portfolio includes assets across Lutyens’ Delhi and South Delhi, two of the most prestigious residential zones in the country. Investors participating in such AIFs are typically seeking both capital appreciation and rental yield, with lower volatility compared to commercial or retail property investments.

Colonies Driving Demand

Some of the prominent Category-A and B colonies witnessing this pricing surge include Mayfair Garden, Panchsheel Park (N, S, and E Blocks), Sadhana Enclave, Anand Niketan, Vasant Vihar, Shanti Niketan, Westend, Chanakyapuri, Golf Links, Jor Bagh, Sundar Nagar, Maharani Bagh, Chirag Enclave, Greater Kailash, Green Park, Gulmohar Park, and Niti Bagh.

These localities have historically enjoyed high demand due to their central positioning, access to embassies, elite schools, private hospitals, clubs, and green cover.

The report concludes that South Delhi’s luxury real estate market is likely to remain resilient and demand-driven, backed by fundamentals like location, limited supply, and an evolving preference for independently owned floors over builder apartments or high-rises. The involvement of regulated investment platforms is expected to enhance transparency and drive further capital into the sector.

With appreciation trends showing no sign of plateauing, Golden Growth Fund projects continued investor interest and potential for further value unlocking through redevelopment and long-term holding strategies.

.png)