5 Major Risks of Assured Return Schemes

- Assured ≠ Guaranteed – Most promises are marketing claims, not legally enforceable.

- Dependence on Issuer – Payouts rely entirely on the promoter’s financial health and project performance.

- Liquidity Traps – Funds are often locked in with limited options for early exit.

- Unrealistic Risk–Return Profile – High returns with low risk defy basic investment principles.

- Hidden Fine Print & Regulatory Gaps – Complex clauses and weak oversight can leave investors exposed.

What “Assured Returns” Means?

Assured returns are basically an investment arrangement under which an investor is promised to receive a payout at a fixed rate of return, often a rate higher than the average market yield over a given period. The schemes are sold in a number of sectors like real estate, corporate fixed deposits, insurance, or alternative investment plans. However, truly guaranteed returns are those which are a contractually binding agreement and have the backing of a well known institution.

On the other hand, assured returns nowadays are mostly just marketing gimmicks and are not legally enforceable in the same way. The return mainly depends on the issuer's financial position, market conditions, or the business's success rather than a contractual guarantee that is supported by a regulatory safety net.

Therefore, the word assured can mislead, 'it is often taken to mean guaranteed, but it generally carries a significantly higher risk than investors are usually aware of'.

How the Assured Returns Model Works?

1- Promises to Investors

Promoters of assured return schemes typically advertise attractive, steady payouts — for example, “10% annually” for a 3-year term. They appeal especially to investors who are seeking predictable income and want to avoid market volatility.

In real estate assured return models, for example:

Developers sell units (such as commercial spaces) with commitments to pay investors a fixed return (e.g., monthly rental income or annual percentage) until a particular milestone such as project possession or lease period.

These returns are set just like a fixed deposit, but they depend on the developer’s ability to collect rents, sell space, or complete the project.

2- Funding the Payouts

- The internal mechanics often involve upfront capital from investors:

- Investors pay money early in exchange for the promised returns later.

- Developers or scheme operators use that capital for construction or operations.

This leads to a funding chain in which money of present investors is used to pay the promised payouts. When advertising is good, and the first investors get paid, it strengthens the conviction in the project. However, such a plan can become unstable if there are changes in the environment.

3- Regulatory Environment

Critically, many markets treat promises of assured or guaranteed returns with scrutiny:

- Stock exchanges caution investors not to invest in schemes that promise guaranteed returns on stock market investments because they are prohibited by law and not endorsed by regulators.

- In India, regulators have instructed mutual funds to stop advertising “assured returns,” emphasizing that mutual funds cannot promise returns as their values depend on market performance.

This regulatory context means many assured return products may exist in a grey zone — marketed attractively but lacking strong legal backing.

Where the Assured Returns Model Fails?

No True Guarantees

A fundamental weakness is that these returns are often not legally guaranteed in the same way as bank deposits or government bonds. If the issuing entity runs into financial distress or defaults, investors may have little recourse.

For example:

- In real estate assured return models, if rental demand collapses or project delays occur, developers may lack the cash flow to pay returns.

- In corporate assured return schemes, bankruptcy or liquidity crunches can leave investors unpaid.

Thus, the “assurance” exists more in marketing language than in enforceable contractual reality. This contrasts starkly with guaranteed return products where payouts are contractually binding regardless of external conditions.

Liquidity and Lock-Ins

Many assured return schemes are highly illiquid. That means an investor’s money may be locked up for years with limited options to withdraw early without penalties. Real estate schemes, for instance, might require waiting until project completion or contractual dates before any exit — even if the investor needs funds urgently.

Overly Optimistic Assumptions

- Promoters often rely on optimistic assumptions such as:

- Rental yields that remain high despite market cycles.

- Project completion timelines that ignore common construction delays.

- Strong market demand that may not materialize.

If these assumptions fail — say, due to slowing economic growth, rising interest rates, or oversupply — the model’s economics break down. Investors then may not receive promised payments or may get delayed payouts.

What Investors Miss?

The Difference Between Assured and Guaranteed

One of the things people miss the most is the fact that assuredness is not the same as guaranteed.

Guaranteed returns are those that you can legally enforce and are also backed by strong institutions (e.g., government bonds, bank deposits).

This nuance is subtle but crucial, investors thinking they are as safe as bank instruments may be wrong.

Lack of Risk Compensation Understanding

Finance theory tells us that returns are typically correlated with risk — higher returns usually mean higher risk. Any promise of high returns with low risk should raise red flags. This is similar in principle to warnings about Ponzi schemes, which often lure investors with high, steady returns that cannot be substantiated by underlying business performance.

Investors tend to underestimate the risk and overestimate the likelihood of payout because payouts may happen initially, until market conditions change.

Complexity and Fine Print

Assured return contracts often contain complex clauses that limit investor rights or impose conditions such as:

- Minimum holding periods.

- Requirement to reinvest payouts.

- Clauses that adjust returns under certain events.

Investors often focus on advertised headline returns and miss these contractual details.

Psychological Biases

Some behavioral psychology plays a role:

- Anchoring bias makes investors fixate on the promised return percentage and ignore risks.

- Herd behavior leads people to follow others into assured return investments without independent due diligence.

These cognitive biases inflate demand for schemes that might otherwise warrant skepticism.

Types of Assured Return Schemes and Common Pitfalls

1- Real Estate Assured Return Models

In real estate, assured return schemes work like this:

- Developers offer property units at a price.

- Investors are promised fixed rental income or return percentages — often higher than typical rental yields.

Problems include:

- Projects can be delayed or fail.

- Rental demand might be weak.

- Developers may allocate cash flows elsewhere.

These risks mean returns can fail or be delayed.

2- Insurance and Corporate Products

In insurance plans that use the term “assured,” payouts may depend on company performance, survival of the policyholder, or payment of premiums. These are not the same as guaranteed returns and can vary significantly.

3- Prohibited Assured Return Offers in Stock Markets

Regulators warn investors that any stock market product promising assured returns is prohibited and not authorized. Investors in such schemes may lose legal protections.

Key Red Flags Investors Should Watch For;

Below are common warning signs:

- High returns with low risk , unrealistic under normal market conditions

- Lack of regulatory oversight or licensing, serious concern

- Unregistered promoters or entities , signals possibility of fraud

- Complex contractual language with opaque clauses

- Promises that sound “too consistent” across all market environments

- Heavy upfront fees or fund lock-ins

Better Approaches to Investing

If long-term and predictable income is a priority, consider:

- High-quality bonds or government securities

- Bank fixed deposits or sovereign schemes with guaranteed returns

- Diversified portfolios that balance risk and return through modern portfolio theory principles

- Diversification spreads risk and avoids over-dependence on any single assured return promise.

Assured Return Investments: Real-World Case Studies

Example- Commercial Real Estate – Under-Construction Office Project

The first example involves a Grade-A commercial office project in a major metro city. The developer, a mid-sized firm with a solid track record, offered assured returns to attract early-stage investment while the project was under construction. The investment targeted investors seeking predictable income during the construction period.

Investment Highlights:

- Capital per investor: ₹50 lakh

- Assured return: 9% per annum

- Payout frequency: Quarterly

- Tenure: 24–30 months

The returns were funded through a combination of developer cash flows and pre-sales of select units. Post-completion, rental income from corporate tenants contributed additional cash flow for investors. Risk was mitigated through milestone-based payouts and a clear exit strategy at possession.

Outcome & Insights:

- Investors received all quarterly payouts on time

- Capital appreciation occurred post-possession

- Developer accelerated project delivery

Key learning: Credible developers with structured cash-flow plans significantly increase the success of assured return schemes.

Example of Structured Debt – Lease-Backed Warehousing Project

In this example, investors participated in a lease-backed logistics and warehousing park. The sponsor was a reputed logistics infrastructure company, and tenants were multinational firms with strong credit profiles. This structure provided investors with stable, predictable income backed by legal safeguards.

Investment Highlights:

- Assured return: 10.5% per annum

- Tenure: 4 years

- Payout frequency: Quarterly

- Security: Escrow of lease rentals + mortgage of the asset

The returns were generated from long-term lease rentals, routed through escrow to ensure priority payouts. Investors enjoyed steady returns while the sponsor used the stabilized cash flows to refinance the project at a lower cost.

Outcome & Insights:

- Steady quarterly income without disruption

- Appreciation of asset value over tenure

- Sponsor achieved favorable refinancing

Key learning: Lease-backed structures with escrow accounts provide one of the most secure forms of assured returns.

Example of Residential Pre-Launch Project – Failed Assured Return

This case highlights the risks of high promised returns without structural safeguards. A first-time developer offered a 12% per annum assured return for a pre-launch residential project. However, the project lacked escrow accounts or collateral security, and timelines were aggressive.

Investment Highlights:

- Capital per investor: ₹30 lakh

- Assured return: 12% per annum

- Tenure: Until possession

- Security: None

Due to construction delays and weak cash flow, the developer failed to deliver payouts on schedule. Investors faced capital lock-in, income disruption, and eventually legal disputes.

Outcome & Insights:

- Payout defaults and delayed construction

- Investor losses due to lack of safeguards

Key learning: High assured returns alone are not reliable; enforceable legal structures and credible sponsors are critical.

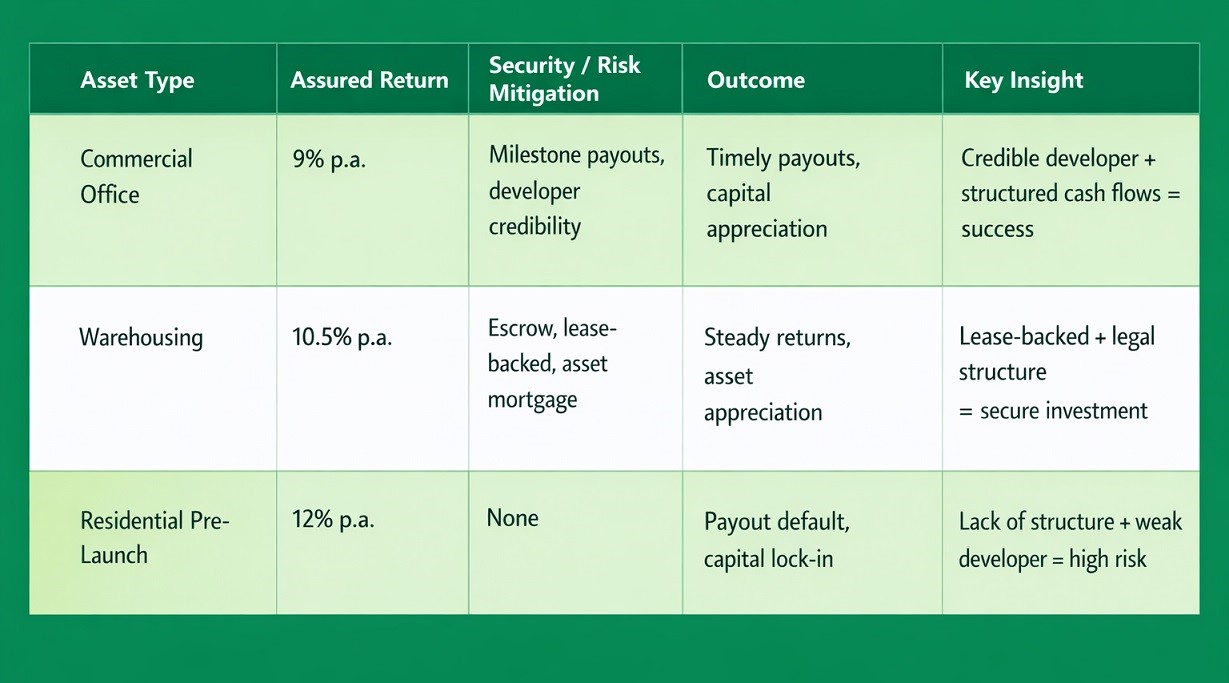

Summary Table Key Comparisons

Be Informed and Skeptical

Assured returns may seem quite attractive on account of their promise of stability and steady income, but in fact, they are very seldom entirely guaranteed. These types of models depend largely on the financial stability, trustworthiness, and continued performance of the issuer which makes them subject to market fluctuations and operational risks.

There are quite a few investors who miss these risks that are sometimes deeply hidden in the fine print or are made less threatening by the persuasive nature of advertisements. It is very important to clearly understand the difference between assured and guaranteed returns levels and also to consider the underlying economic factors of the promise before making a decision to invest. Sensible investors should always perform proper investigation, carefully check contractual clauses, and get professional financial advice rather than just depending on promotional statements.

.png)