India’s flexible office sector is rapidly expanding, with total stock expected to exceed 100 million square feet by 2026, according to Cushman & Wakefield’s Global Trends in Flexible Office 2025 report. As of Q2 2025, India already accounts for 79.7 million sq. ft. across its top eight cities, making it the largest flexible workspace market in the Asia-Pacific region.

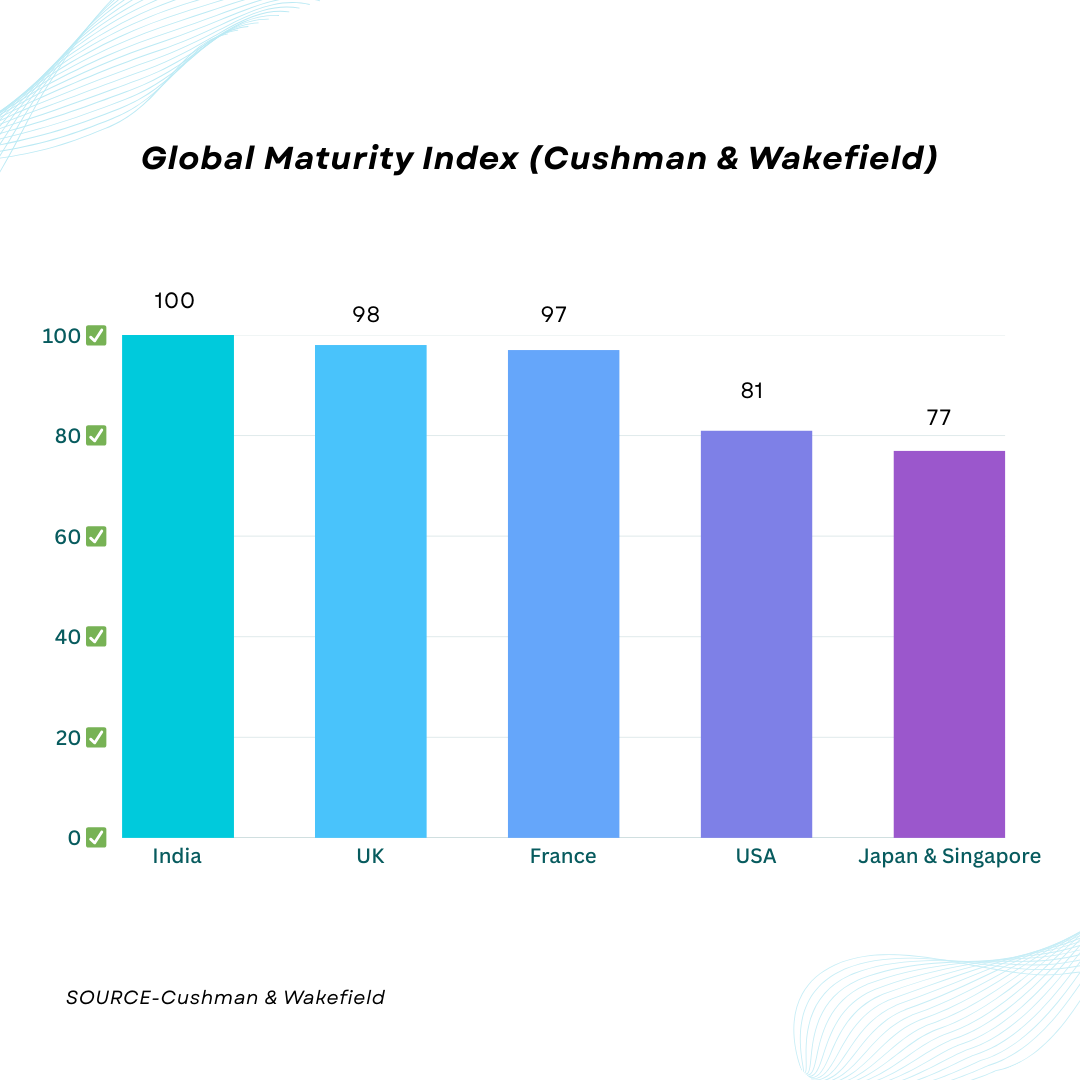

Bengaluru remains the top city for flexible office stock, with 21.1 million sq. ft., nearly one-third of the national total. Delhi-NCR, Pune, and Hyderabad follow, adding significant volumes. The country’s rapid progress is reflected in Cushman & Wakefield’s maturity index, where India scored 100, surpassing the United Kingdom (98), France (97), the United States (81), and Asian hubs such as Japan and Singapore (77 each). The index measures factors including flexible stock share, operator diversity, and innovative leasing models.

Demand Growth and Corporate Drivers

Demand for flexible offices has increased sixfold since 2020. In 2024, flexible offices accounted for 15% of new office leasing activity. International enterprises drive the majority of demand, representing 72% of leasing activity, with Global Capability Centres (GCCs) playing a significant role. Start-ups contribute 28%, reflecting the sector’s dual appeal to established corporations and emerging businesses.

India’s cost efficiency has been a major growth driver. Average fit-out costs in metros such as Mumbai, Delhi, and Bengaluru stand at around $75 per sq. ft., less than half of comparable Western markets. Managed office and enterprise solutions now account for up to 80% of post-pandemic demand. Institutional interest is increasing as well, with four flexible workspace operators already publicly listed and more IPOs expected. Analysts anticipate consolidation over the next three to five years, with larger players strengthening market share through acquisitions and strategic expansions.

Ramita Arora, Managing Director for Bengaluru and Head of Flex, India at Cushman & Wakefield, noted that India’s flexible office sector is increasingly acknowledged as a global benchmark. She highlighted that the market stands out for its maturity, diversity of operators, and ability to adapt quickly to changing demand—attributes that remain under development in several Western markets. This assessment places India in a distinctive position within the global flexible office ecosystem, strengthened by innovation and adaptability.

Expansion into Tier-II Cities

While top-tier cities continue to dominate, demand is expanding into Tier-II cities such as Jaipur, Kochi, and Visakhapatnam. Analysts note that flexible office spaces in emerging cities are becoming increasingly central to corporate real estate strategies, offering scalable and cost-effective solutions for businesses operating outside major metros.

The sector’s growth is underpinned by evolving workplace preferences, with companies seeking flexibility in office size, lease duration, and operational models. Flex office operators have responded with hybrid setups, plug-and-play spaces, and fully managed solutions tailored to both large enterprises and start-ups.

With strong corporate demand, favorable cost structures, and increasing institutional investment, India’s flexible office market is expected to maintain momentum through 2026 and beyond. Analysts predict that the sector will continue to expand geographically and operationally, reinforcing India’s status as a leading flexible workspace hub in the Asia-Pacific region.

India’s flexible office ecosystem demonstrates both scale and sophistication. Bengaluru leads supply, while Tier-II cities are emerging as growth areas. Rising demand from multinational enterprises, GCCs, and start-ups, combined with competitive costs and operator innovation, positions India to surpass 100 million sq. ft. by 2026, solidifying its role as a global leader in flexible office solutions.

.png)