Mumbai Real Estate: JP Morgan Powai Lease- Key Highlights

- JP Morgan leased over 13 lakh sq ft of built-to-suit office space in Powai, Mumbai, with a total rental commitment of more than ₹5,200 crore, making it one of India’s largest single-tenant office lease deals.

- The office space at One Forest Avenue, Powai, is being developed by a Brookfield-backed SPV and will house JP Morgan’s largest Global Capability Centre (GCC) in Asia.

- The lease has a 20-year structure with an initial 10-year term, starting monthly rent of around ₹39 crore, and an annual escalation of 4.5%, reflecting a long-term commitment to India.

- JP Morgan paid ₹468 crore as security deposit, while the transaction attracted ₹125 crore in stamp duty, highlighting the scale and financial significance of the deal.

JP Morgan Services India Private Limited, in one of the largest commercial office transactions in India, has leased a built, to, suit commercial office space of more than 13 lakh square feet at Powai, Mumbai, for a total rental commitment of over 5, 200 crore, according to the documents of property registration accessed by CRE Matrix. This agreement demonstrates the increasing dimension of global capability centers (GCCs) in India and strengthens Mumbai's status as a prime location for high value office demand from multinational financial institutions.

The property has been leased to the company from BSS Property Ventures Private Limited and Rajeshwar Property Ventures Private Limited, a special purpose vehicle (SPV) in which Brookfield Properties is a shareholder. The office space is at One Forest Avenue, Powai, and JP Morgan is expected to set up its global capability centre here, which will be the largest GCC of the company in Asia.

Prior to this, in December 2025, Brookfield Properties had confirmed that it had signed a built, to, suit lease agreement with JPMorgan Chase for the construction of the Powai facility.

According to the deal, JP Morgan will be the only tenant of the campus and the lease will be for a term of 20 years, thereby showing a long term commitment to India's financial and technology ecosystem.

Important details of the deal

As per the registration details, the lease agreement has a starting monthly rent of approximately ₹39 crore, which means the starting rental rate is around ₹300 per square foot. The registration of the deal was completed on December 24, 2025, with JP Morgan paying a security deposit of ₹468 crore.

The important details of the deal are as follows:

- Total leased area: Approximately 13 lakh sq ft

- Lease term: Initial lease term of 10 years, with rent calculation on a 20-year basis

- Annual escalation: 4.5 per cent

- Stamp duty paid: ₹125 crore

- Registration fee: ₹30,000

- Building design: 19 floors, including the ground floor

- Parking space: Approximately 1,300 parking spots

The stamp duty has been paid on the longer lease term, although the initial lock-in period is set for a decade. The deal is one of the largest single-tenant office leases in the Indian real estate sector.

Brookfield’s GCC push in Maharashtra

The transaction aligns with Brookfield’s broader investment plans in Maharashtra. In December 2025, Maharashtra Chief Minister Devendra Fadnavis had stated that Brookfield was set to invest around ₹9,000 crore to establish a large global capability centre facility in the state. Brookfield later clarified that it plans to develop a 2 million sq ft GCC campus in Powai, expected to become Asia’s largest GCC for a multinational bank.

The Powai development is being built on a six-acre site, acquired by a Brookfield Asset Management–backed private real estate fund. The project is being developed through an agreement between the Mumbai Metropolitan Region Development Authority (MMRDA) and a venture led by Brookfield in partnership with B S Sharma. Completion is targeted around 2030, after which the campus will consolidate several of JP Morgan’s Mumbai operations into a single, state-of-the-art facility.

Brookfield Properties is a real estate investment, management, and development company, operating one of the biggest office platform businesses in India. Its holdings are spread across seven cities and total around 55 million sq ft.

Being in a fully mixed, use neighborhood and well connected, the Powai project's location is a big plus. Besides, the availability of the necessary social infrastructure and the easy access to a highly skilled workforce are other advantages of this location.

JP Morgan’s recent office leasing activity

JP Morgan has been an active participant in Mumbai’s commercial real estate market over the past year. Recently, the firm leased over 2.71 lakh sq ft in Powai’s One Downtown Central for a five-year term, with a total rental value of around ₹612 crore. The space was taken on lease from Cowrks India, a managed workspace provider backed by Brookfield Properties.

In another transaction, JP Morgan Services India Private Limited had pre-leased 1.16 lakh sq ft in a commercial tower being developed by Goisu Realty, a subsidiary of Japan’s Sumitomo Realty & Development Company, in Bandra Kurla Complex (BKC). That deal involved a monthly rent of around ₹6.9 crore for a 10-year term.

GCCs driving office demand

Global capability centres are arguably one of the most powerful forces that have driven office leasing not only in the prime cities of India, but also across the country. Based on data from Savills India, in the five years from 2020 to 2024, GCCs have fetched 112 million sq ft of office space through leasing. The cities of Mumbai and Pune together took 22 per cent of this demand, while Mumbai alone had about 8 per cent.

Even though Bengaluru has the most comprehensive BFSI talent pool, the highest volume of leasing by BFSI, focused GCCs was recorded in Mumbai, thereby emphasizing the citys role as a financial capital for India. Transactions on a large scale and for long durations, such as JP Morgan's Powai lease, definitely spotlight the increasing prominence of India as a worldwide center for high value corporate operations.

As per, Savills India Global Capability Centres: Enabling India’s Strategic Advantage Report, Global Capability Centres (GCCs) in India are set to grow owing to multiple favourable factors. These consist of the regulatory regime, India’s abundant talent pool, cost efficiencies in terms of lower manpower and rental costs, and the growing attractiveness for innovation and R&D hubs. This is expected to translate into higher office space take-up by GCCs.

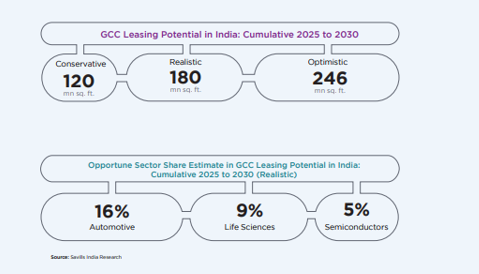

The research indicates that incremental GCC leasing in India is estimated to be around 120- 246 mn sq. ft. during 2025-2030, depending on the global business environment.

Research estimates the potential of three sectors that will likely gain share in GCC leasing going forward. Automotive, Semiconductors and Life Sciences GCCs are likely to constitute 30% of the total estimated GCC leasing of 180 mn sq. ft. in India between 2025 and 2030.